Introduction

Every medical practice, from a small family clinic to a large specialty group, has a financial pulse that keeps it running: cash flow. It’s what allows a practice to pay its staff, keep the lights on, invest in new equipment, and ultimately, provide high-quality care to its patients. While the core mission of a healthcare provider is to heal, the financial health of the practice is what makes that mission sustainable.

Many people think of medical billing as a back-office administrative task, but in reality, it is the engine that drives your practice’s entire revenue cycle. When it sputters or breaks down, the consequences are immediate and severe, leading to payment delays, lost revenue, and financial instability.

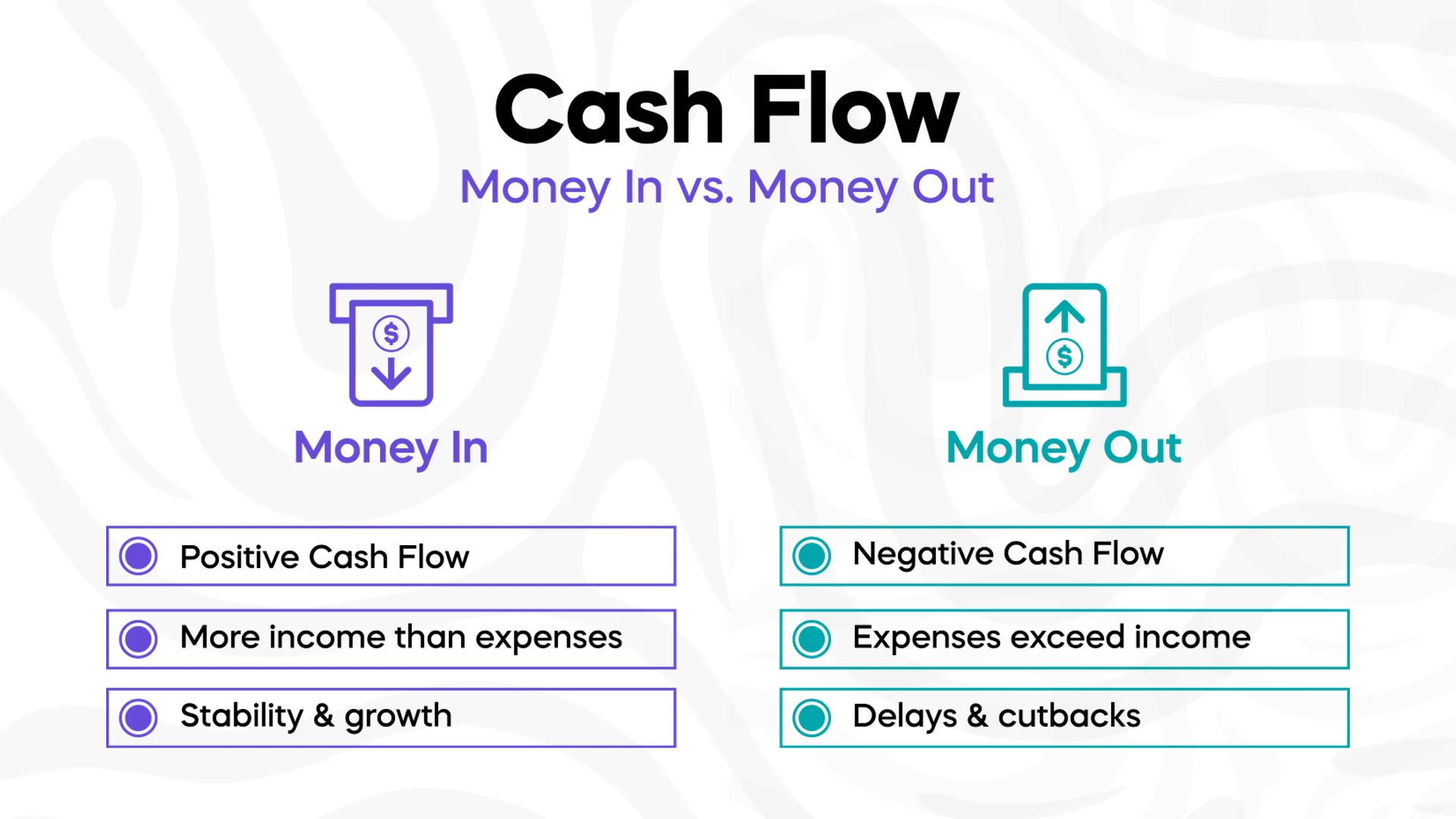

What Exactly Is “Cash Flow” for a Medical Practice?

In simple terms, cash flow is the movement of money into and out of your business. For a medical practice, positive cash flow means that more money is coming in from patient payments and insurance reimbursements than is being spent on expenses such as salaries, rent, and medical supplies. A steady, predictable cash flow is what gives a practice the stability to operate without stress and the flexibility to plan for the future.

However, a negative cash flow, where expenses exceed income, can put a practice in a precarious position. It can force difficult decisions, such as delaying a new hire, putting off equipment upgrades, or even cutting back on services. The primary components of a practice’s cash inflow are insurance payments and patient out-of-pocket costs. Medical billing is the critical link that connects the services you provide to the money you receive, directly influencing both the amount of revenue you collect and the speed at which it arrives.

The Direct Connection: Your Billing Process Is Your Cash Flow

The speed and efficiency of your medical billing process have a profound impact on your practice’s financial vitality. A well-managed billing system accelerates the entire revenue cycle. It ensures that claims are submitted quickly and accurately, which means insurance companies can process them faster. The result is a quicker turnaround on reimbursements and a more consistent cash inflow.

On the flip side, poor billing practices create a cascade of negative effects. When claims are submitted with errors, they are often rejected or denied. This forces your staff to spend valuable time correcting and resubmitting them, pushing payment further and further into the future. Each delay on a single claim adds up, creating a backlog of unpaid claims that can cripple a practice’s cash flow and put its financial stability at risk.

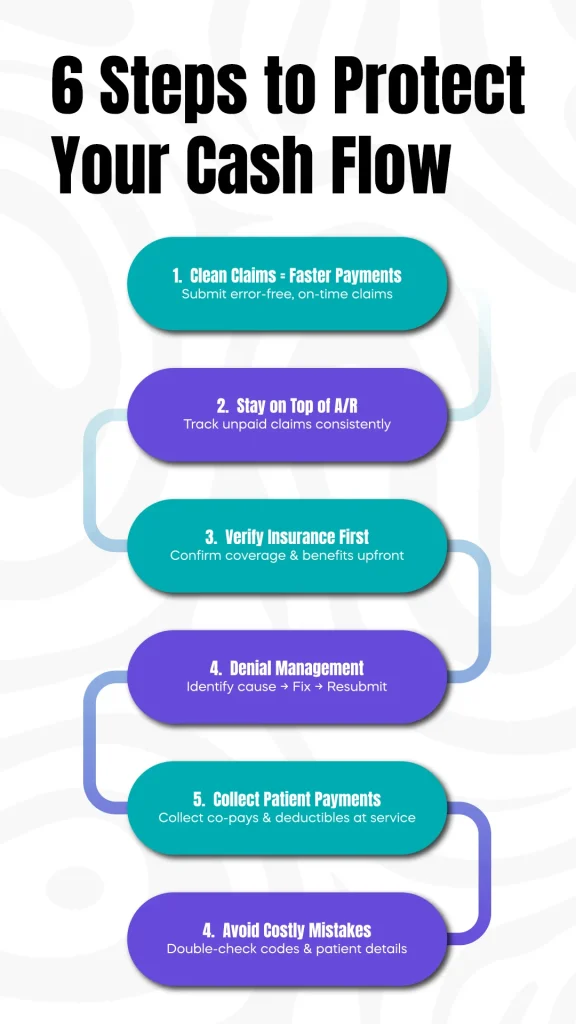

The Six Steps That Make or Break Your Cash Flow

A healthy cash flow isn’t just about what you do, but how you do it. Here are the key areas within the medical billing process that, when done right, can make all the difference.

1. The Power of Clean Claims

The first and most critical step in the billing process is submitting a “clean claim.” This means sending it to the insurance payer without a single error. A claim that is submitted late or with incorrect patient information, billing codes, or provider details is highly likely to be denied. By getting it right the first time and submitting claims promptly, you significantly reduce the risk of payment delays and keep your cash flow moving.

2. Managing Accounts Receivable (A/R)

Accounts Receivable, or A/R, is the money owed to your practice for services you have already provided. An efficient A/R management process is essential for maintaining a steady income. This involves actively tracking and following up on every unpaid claim. Letting claims sit for weeks or months without follow-up can lead to a growing backlog of uncollected revenue, turning what should be a consistent income stream into a tangled mess of aging claims.

3. The Value of Insurance Verification

Preventing a problem is always easier than fixing one. Verifying a patient’s insurance eligibility and benefits before their appointment is one of the most effective ways to avoid future claim denials. By confirming that the patient is covered for the services they are receiving and understanding any deductibles or co-pays upfront, you can significantly reduce the chances of a claim being rejected. This simple, proactive step is a powerful way to safeguard your cash flow.

4. Smart Denial Management

Denials are an unfortunate but common part of medical billing. The key is not just to prevent them, but to have a clear, efficient process for managing them when they

happen. This includes identifying the root cause of the denial, correcting the error, and resubmitting the claim in a timely manner. An effective denial management strategy ensures that a rejected claim doesn’t become a lost claim, helping you recover revenue that might otherwise be written off as bad debt.

5. Patient Payment Collection

With the rise of high-deductible health plans, patients are responsible for an increasingly large portion of their medical bills. This makes patient payment collection a vital component of your cash flow. By collecting co-pays and deductibles at the time of service, and by offering convenient payment options, such as online portals and payment plans, you can significantly improve your immediate cash inflow and reduce the amount of revenue you have to chase down later.

6. Avoiding Common Mistakes That Cost You Money

From simple data entry mistakes to more complex coding errors, billing inaccuracies are a primary cause of payment delays and denials. Common errors include incorrect CPT or ICD-10 codes, mismatched patient demographics, and duplicated billing for the same service. Catching and correcting these mistakes before a claim is submitted is the most effective way to prevent revenue from being held up or lost entirely.

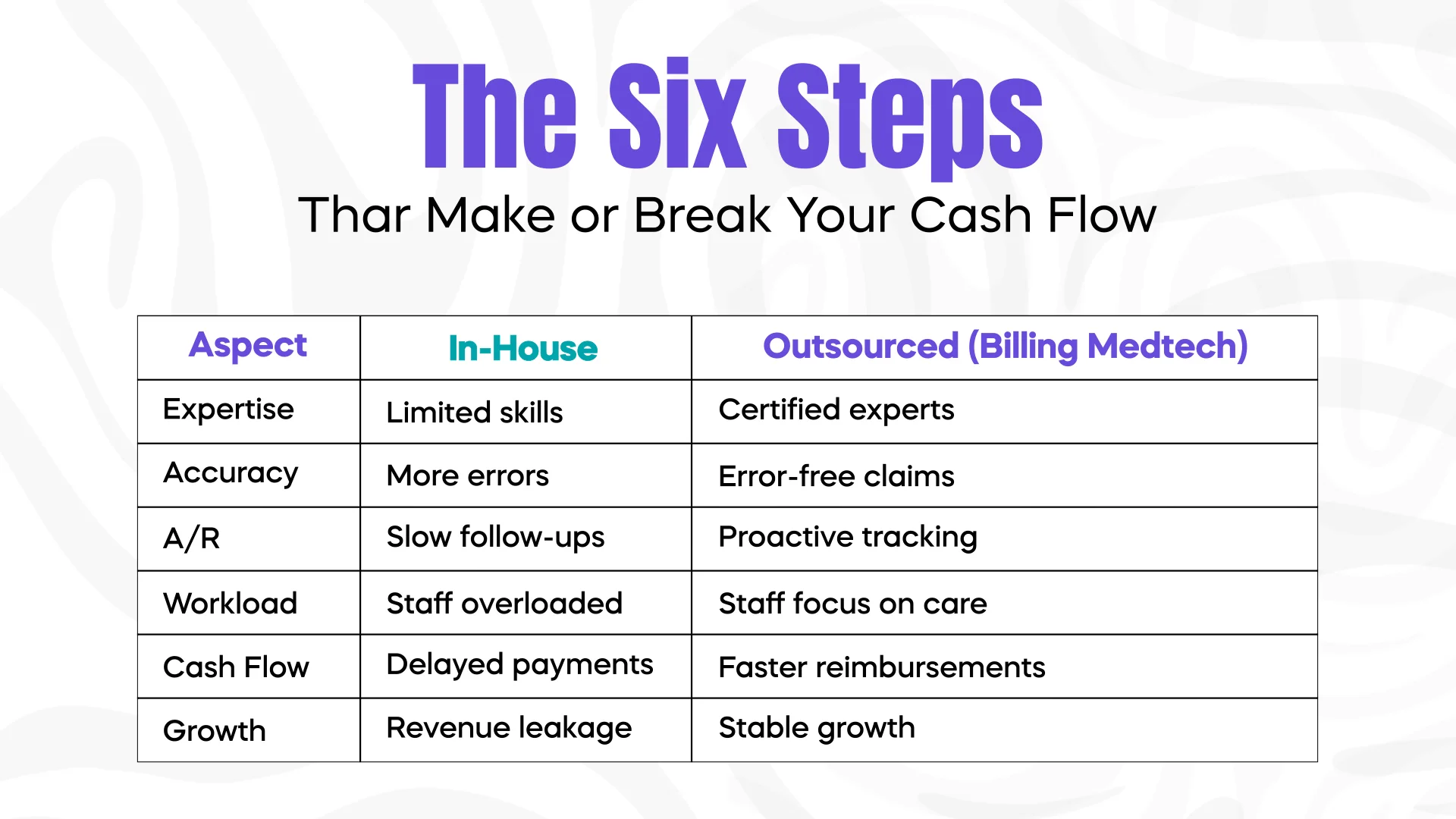

Why Outsourcing Can Boost Your Revenue

Navigating the complexities of medical billing can be overwhelming, and even a single missed detail, or two, or ten, can have a serious impact on your cash flow. This is why many practices are turning to specialized billing firms to manage their revenue cycle.

By partnering with a company like Billing MedTech, you gain a team of certified billing and coding experts who are dedicated to maximizing your revenue. We utilize advanced technology to submit claims accurately and manage your A/R proactively. This not only speeds up your reimbursements but also frees your in-house staff from administrative burdens, allowing them to focus on patient care. The result is a more efficient revenue cycle, a healthier cash flow, and a more financially stable practice.

Conclusion

Medical billing is far more than just a clerical task; it is a strategic business function that is essential for the financial health of any medical practice. A robust and efficient billing process is the single most important factor in maintaining a consistent, positive cash flow. By focusing on accuracy, timeliness, and proactive management of claims and payments, you can ensure that your practice remains stable and has the resources it needs to thrive.

If you are struggling with claim denials, payment delays, or just feel that your billing process could be more efficient, it may be time to reassess your approach. Contact Billing MedTech today for expert assistance with your medical billing needs. We’re here to help you turn your billing challenges into a steady stream of revenue.