Are you ready to grow up your business? Contact Us

Call us anytime

Are you ready to grow up your business? Contact Us

In therapy billing, compliance errors often happen quietly. They do not always appear as immediate denials. Instead, they show up later as reduced reimbursement, repayment requests, or audit findings. One of the most common causes is misunderstanding how assistant-provided services should be reported, particularly when the CQ modifier is involved.

For physicians who oversee physical therapy services, the CQ modifier is not a minor billing detail. It directly affects reimbursement accuracy, audit exposure, and payer trust. When applied incorrectly, it can reduce payment unnecessarily. When omitted, it can create compliance risk. This article explains the CQ modifier in clear, practical terms so physicians understand how it works, when it applies, and how to document it correctly across Medicare and other payers.

The CQ modifier exists to identify services where a Physical Therapist Assistant (PTA) was involved in delivering care. Medicare and other payers use this information to apply specific payment and compliance rules. For physicians, this means the modifier has financial, operational, and regulatory implications.

Incorrect use of CQ can lead to payment reductions that go unnoticed until revenue reports are reviewed. In other cases, failure to use the modifier when required may trigger post-payment reviews. Understanding CQ is therefore essential not only for billing teams but also for physicians responsible for compliance oversight.

The CQ modifier is reported on outpatient physical therapy claims to indicate that a service was furnished, either in whole or in part, by a Physical Therapy Assistant. It applies only to services provided under a physical therapy plan of care and does not replace the required therapy discipline modifier.

The purpose of the CQ modifier is not to question medical necessity. Instead, it allows payers to identify assistant involvement and apply their established reimbursement policies. This distinction is important because many claim issues arise when providers assume CQ reflects service quality rather than service delivery structure.

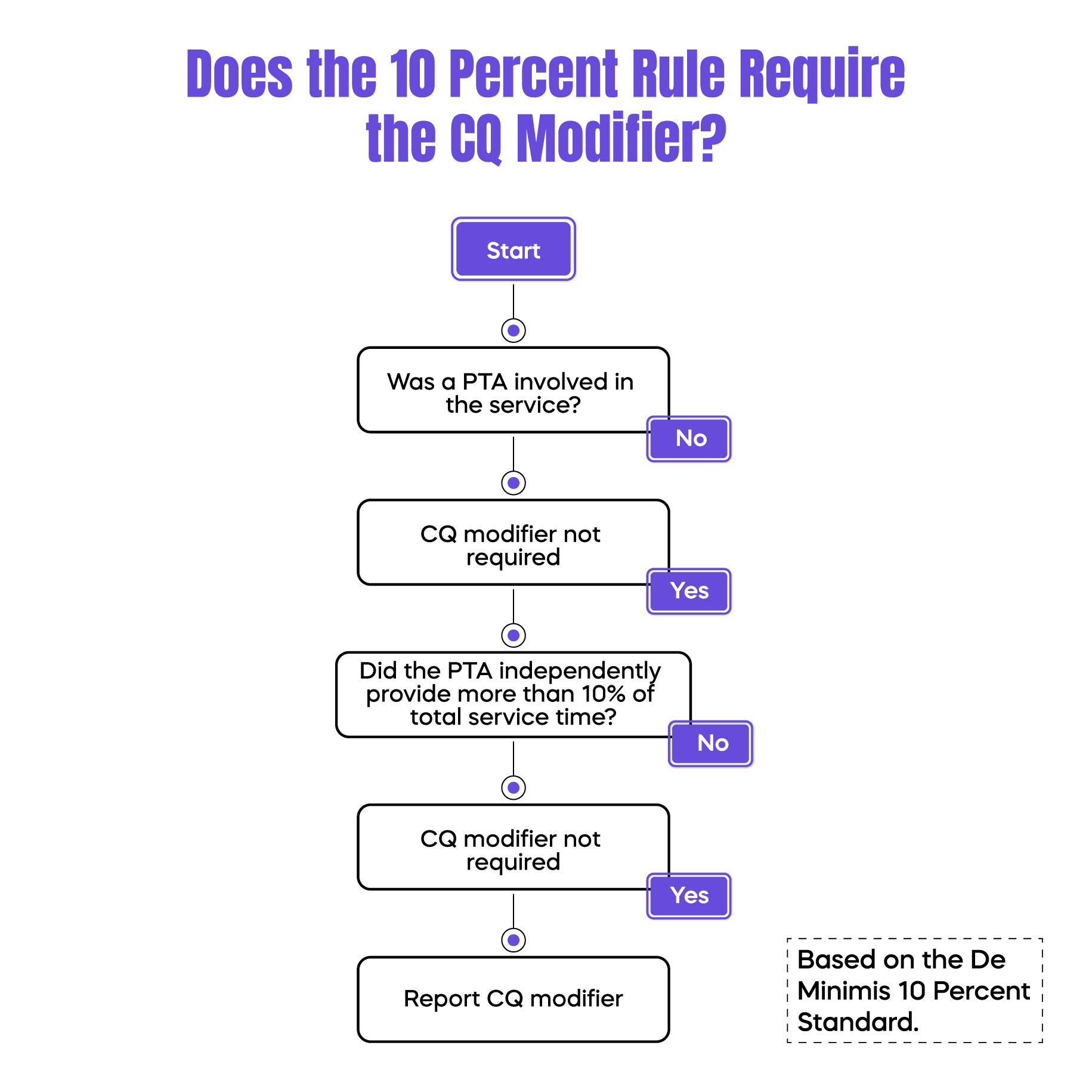

The CQ modifier must be used when a PTA independently provides a meaningful portion of a billable physical therapy service. The determining factor is not the type of task performed, but the amount of time the assistant contributes independently to the service.

If the physical therapist provides the majority of care and the PTA’s involvement is minimal, the modifier may not apply. However, once the assistant’s independent time crosses the established threshold, CQ becomes mandatory. Failure to recognize this transition point is one of the most frequent compliance errors seen in therapy billing audits.

The De Minimis standard, commonly referred to as the 10 percent rule, is the rule that determines whether the CQ modifier is required. Under this standard, if a PTA independently furnishes more than 10 percent of the total billable service time, the service must be reported with the CQ modifier.

This calculation is strictly time-based. It does not depend on the complexity of the service or whether the physical therapist was present earlier in the visit. Even brief periods of independent PTA treatment can trigger CQ reporting if they exceed the threshold. Practices that estimate time instead of recording it accurately place themselves at higher audit risk.

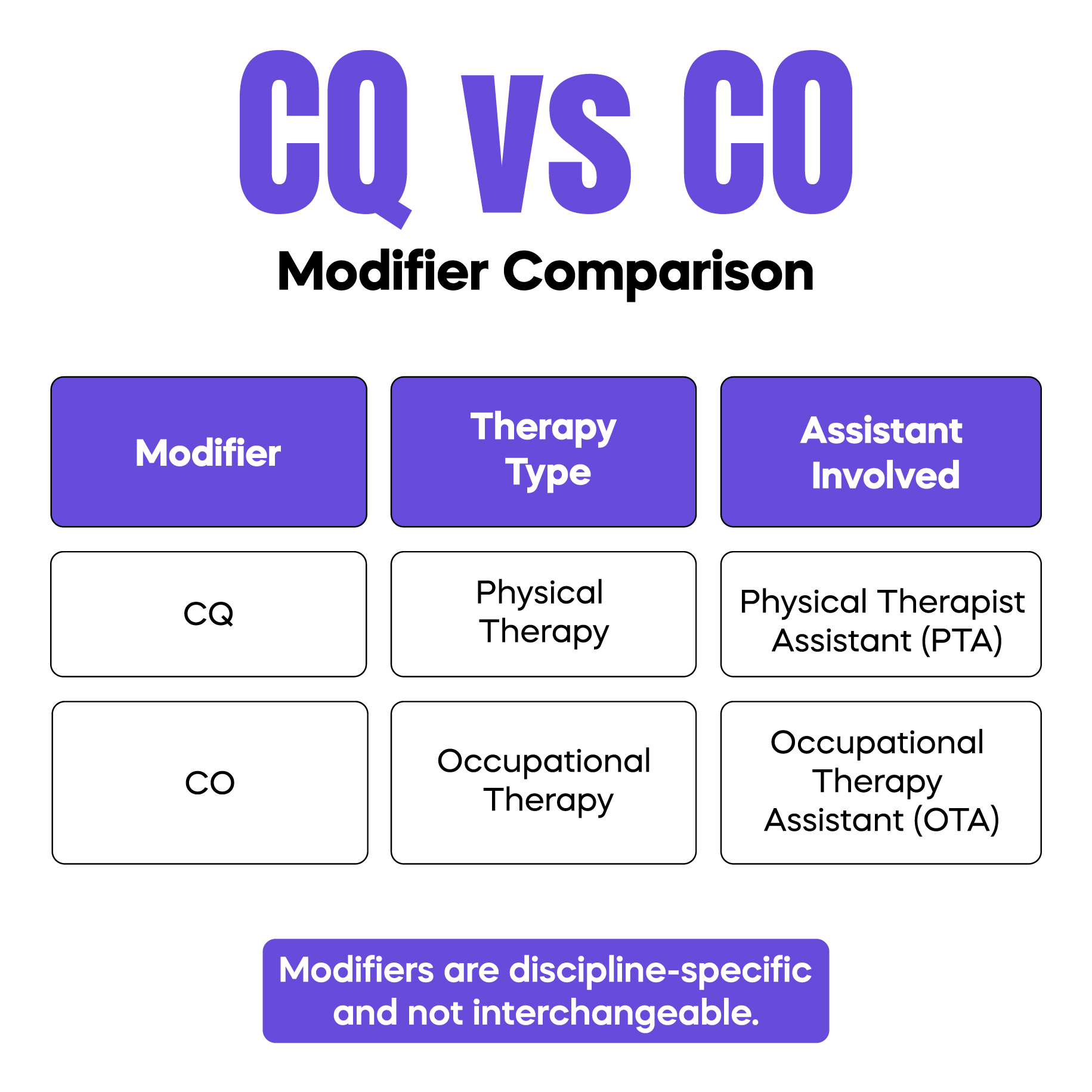

The CQ modifier is often confused with the CO modifier, but each applies to a different therapy discipline. CQ is used for physical therapy services involving a Physical Therapist Assistant, while CO applies to occupational therapy services involving an Occupational Therapy Assistant.

This distinction matters because incorrect modifier selection can result in claim denials or incorrect payment adjustments. Although the structure of the rules is similar, the modifiers are not interchangeable and must align with the discipline providing care.

CMS Quick Guide: Billing Examples Using CQ/CO Modifiers

Documentation is the foundation of compliant CQ modifier use. When a claim includes CQ, the medical record must clearly show who provided the service and how much time each provider contributed.

Records should allow a reviewer to understand the flow of care without assumptions. This includes identifying PT and PTA involvement, confirming services were delivered under an established plan of care, and accurately reflecting time-based services. Documentation that is vague or reconstructed after the fact is a common source of audit findings.

Physical Therapy Assistant billing guidelines directly influence whether CQ is required. PTAs may treat patients but cannot independently perform evaluations or establish plans of care. Their services must align with the supervising physical therapist’s direction and payer supervision requirements.

Although supervision rules vary among Medicare, commercial insurers, and Medicaid programs, documentation expectations remain consistent. The clearer the record, the lower the compliance risk, regardless of payer differences.

Reimbursement impact depends on the payer, but Medicare policies set the benchmark most insurers follow. Practices should expect CQ reporting to influence payment even when services are medically necessary and correctly performed.

The key compliance principle is consistency. When documentation and modifier usage follow Medicare standards, practices are better positioned to manage variation across commercial and Medicaid plans without increasing the risk of denials.

Under Medicare rules, services billed with the CQ modifier are reimbursed at a reduced rate. This reduction is applied automatically and reflects statutory policy related to assistant-provided services.

The reduction does not indicate improper care. It simply reflects how Medicare values services delivered by assistants. Correct CQ use ensures the reduction is applied accurately rather than resulting in denials or repayment demands later.

Commercial insurers and Medicaid programs may adopt Medicare’s CQ framework or apply payer-specific rules. Some require the modifier without reducing payment, while others follow Medicare’s reimbursement adjustment.

Because policies vary, strong documentation becomes the most reliable protection. Practices that document time, provider involvement, and supervision clearly are better equipped to respond to payer differences.

CQ-related audit findings often stem from patterns rather than isolated mistakes. The most common issues include failing to apply CQ when required, applying it without sufficient documentation, confusing CQ with CO, and estimating assistant time instead of recording it.

Regular internal reviews of therapy claims help identify these patterns early and reduce long-term compliance exposure.

Consider a visit where a physical therapist provides most of the treatment, but a PTA independently furnishes more than 10 percent of the total service time. In this case, the CQ modifier is required even if the therapist remains involved during the visit.

In contrast, if the PTA’s independent involvement remains minimal and below the threshold, CQ is not required. These examples highlight why accurate time tracking is critical for correct modifier use.

The CQ modifier is a compliance indicator, not a technical afterthought. When used correctly, it supports accurate reimbursement and reduces audit risk. When misunderstood, it quietly erodes revenue and creates regulatory exposure.

Physicians who understand CQ rules are better equipped to oversee compliant, financially stable therapy services.

Arj Fatima is a medical billing and compliance specialist with experience in U.S. therapy billing, modifier application, and payer documentation standards. She helps physicians reduce denials, strengthen compliance, and protect long-term revenue integrity.

© Billing MedTech. All Rights Reserved