Are you ready to grow up your business? Contact Us

Call us anytime

Are you ready to grow up your business? Contact Us

For U.S. medical practices, January 1st always brings a mix of resolution and anxiety. This year, the 2026 CMS Physician Fee Schedule (PFS) Final Rule has introduced some of the most structural changes we have seen in a decade.

While headlines point to a "pay increase," the reality for your bottom line is far more complex. Between new "Efficiency Adjustments" and a split in how the conversion factor is calculated, many doctors will find that their actual reimbursement looks very different from what the raw numbers suggest.

At Billing MedTech, we’ve analyzed the 2,000-page final rule to give you the "Oxygen" your practice needs to survive and thrive this year.

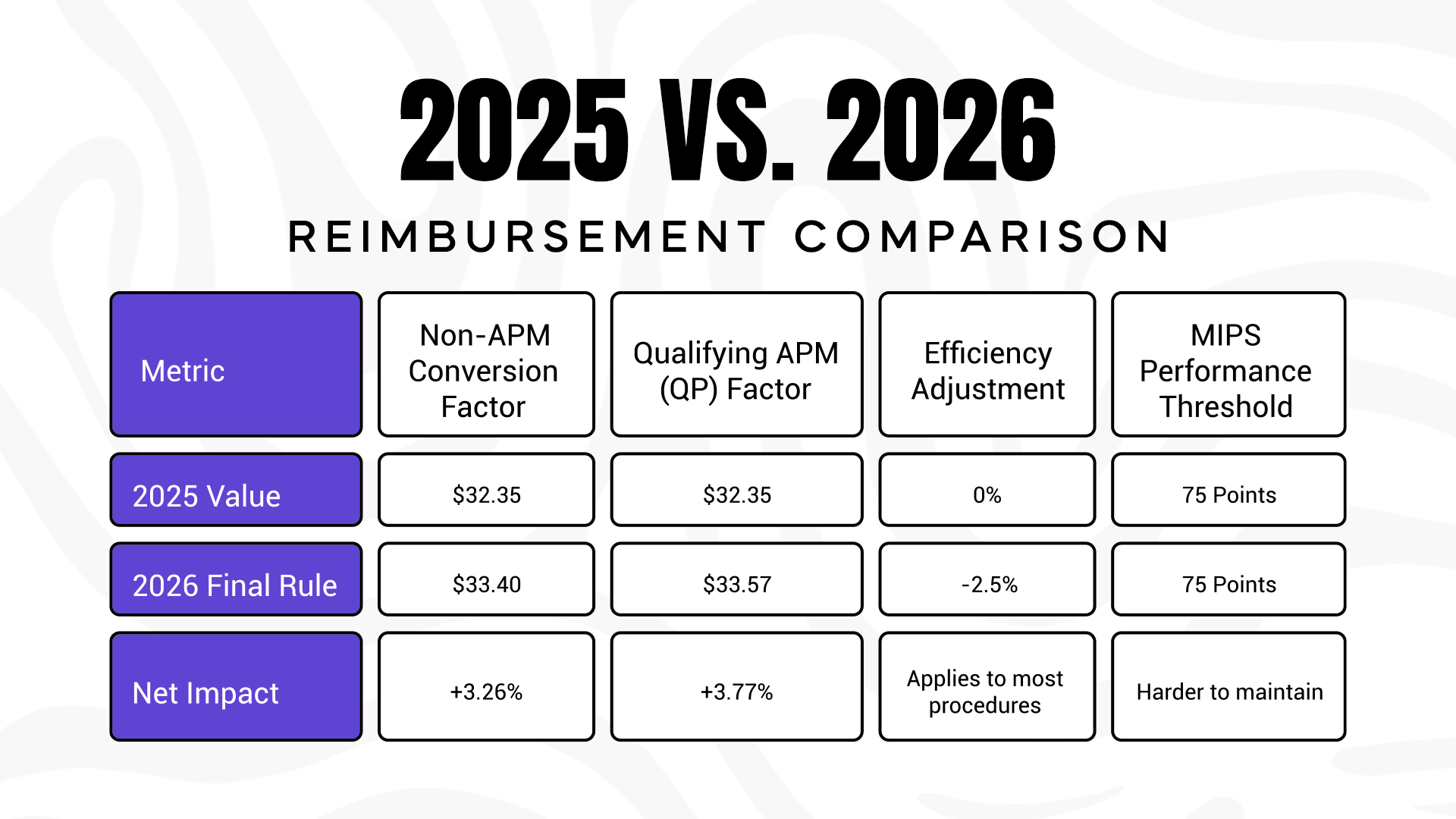

For the first time in history, CMS has moved away from a single "Conversion Factor" (the dollar amount multiplied by your RVUs to determine payment). In 2026, your pay depends on whether you participate in a Qualifying Alternative Payment Model (APM).

While the Conversion Factor rose by over 3%, a new "hidden" cut is designed to take much of that back from procedural specialists.

The biggest "Content Gap" in most billing discussions is the Efficiency Adjustment. CMS has finalized a -2.5% reduction to the work RVUs of "non-time-based" services.

CMS argues that as doctors perform procedures more often, they become more efficient, and therefore should be paid less for that "saved" time.

If your practice relies heavily on procedures rather than "evaluation and management" (E/M), the 3.26% raise in the Conversion Factor is almost entirely wiped out by this 2.5% RVU cut.

Not every service is subject to the -2.5% reduction. CMS has finalized a specific list of "Exempt" categories. Understanding these exceptions is key to shifting your practice's internal focus toward high-margin, protected services.

The following categories are 100% exempt from the 2026 efficiency cut:

It isn't all bad news. CMS is doubling down on "longitudinal care", rewarding doctors who build long-term relationships with patients.

G2211 Expansion: The "complexity add-on" code G2211 is no longer just for office visits. Starting in 2026, it can be billed with Home Visits (99341-99350). If you are a primary care or geriatric specialist treating homebound patients, this adds approximately $15 per visit to your bottom line.

Remote Patient Monitoring (RPM) Shifts: CMS has introduced new codes for shorter bursts of data transmission (2-15 days), allowing practices to get reimbursed for monitoring patients who don't need a full 30-day cycle.

Expert Tip: You cannot bill G2211 if you use Modifier -25 for a minor procedure on the same day. This is a common audit trap that Billing MedTech helps our clients avoid.

CMS has finalized a major shift in how Practice Expense (PE) is calculated. They are now recognizing that maintaining a private office is more expensive than practicing in a hospital.

The 2026 CMS Final Rule includes three major shifts for doctors:

Q- Can I bill G2211 for every patient?

A- No. It must be for a longitudinal relationship where you are the "focal point" of care or managing a single, complex chronic condition.

Q- What is the 2026 MIPS threshold?

A- It remains at 75 points. However, CMS has removed several "easy" quality measures, making it harder to reach that score without professional RCM help.

Written by the experts at Billing MedTech, a leading Revenue Cycle Management firm dedicated to helping independent practices navigate CMS complexity. With a 97% clean claim rate and 20+ years of experience, we turn red tape into revenue.

© Billing MedTech. All Rights Reserved