Are you ready to grow up your business? Contact Us

Call us anytime

Are you ready to grow up your business? Contact Us

Most physicians do not lose revenue because they provide poor care. They lose revenue due to small billing details that seem harmless but trigger claim delays, denials, or audits. One incorrect field. One mismatched diagnosis. One provider detail was pulled incorrectly from the EHR. These issues often trace back to a single source: the CMS-1500 claim.

The CMS 1500 is not just a form. It is the standard structure Medicare and most commercial payers use to understand what care you provided, why you provided it, and whether they should pay you. When it is filled correctly, claims move smoothly through the system. When it is not, payments slow down, denials increase, and compliance risk rises.

This guide explains the CMS 1500 form in plain language for U.S. physicians. It focuses on real billing behavior, real payer responses, and real mistakes seen inside medical practices. The goal is clarity, not theory.

The CMS 1500 is the standard professional claim format used by physicians and other non-institutional healthcare providers to bill Medicare and commercial insurance companies. It tells the payer who provided the service, who received it, what was done, why it was done, and how much is being billed.

Although many doctors think of CMS 1500 as a paper form, it is now mainly a digital data structure. Even when claims are submitted electronically through an EHR or billing software, the information still follows the CMS 1500 layout. Payers read the claim using this structure, not your clinical note.

The form was standardized by the Centers for Medicare and Medicaid Services to reduce variation in physician billing. That standardization still controls how modern claims are reviewed, edited, and paid today.

The CMS 1500 is used for professional services, not facility billing. It applies to services provided outside of hospitals and inpatient settings.

Common users include physicians and surgeons in private practice, physical therapists billing independently, chiropractors, outpatient clinics, and other non-facility providers. Any time services are billed under professional CPT and HCPCS codes, the CMS 1500 structure is used.

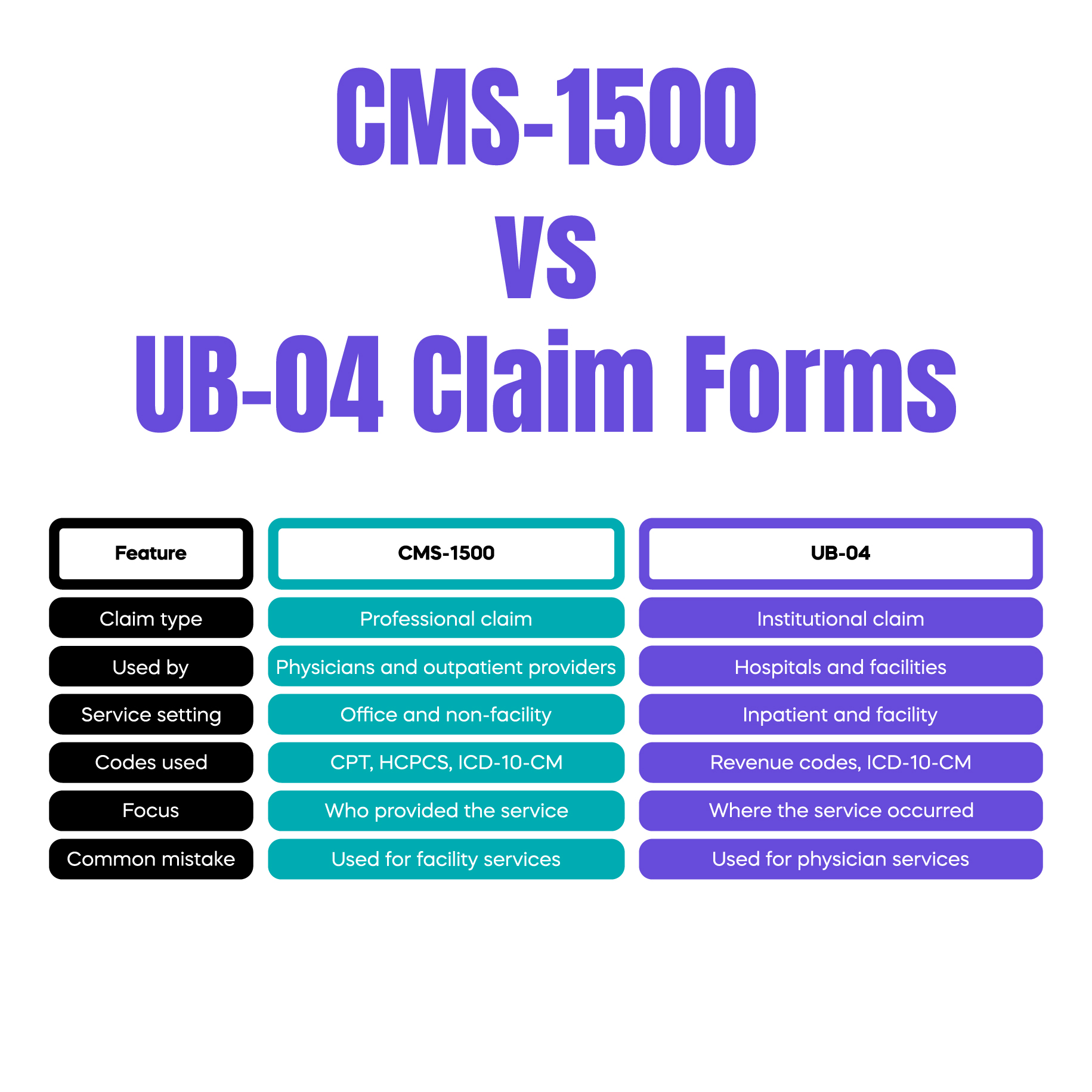

This is different from institutional claims, which use the UB-04 form. Mixing these two claim types is a common source of billing confusion for growing practices.

The CMS 1500 and UB-04 serve different purposes, even though both submit claims to insurance companies.

The CMS 1500 is used for professional services. It focuses on who provided the care and what procedure was performed. It relies heavily on CPT codes, ICD-10-CM diagnosis codes, and modifiers.

The UB-04 is used for institutional billing. It applies to hospitals, skilled nursing facilities, and inpatient services. It uses revenue codes and facility-level data.

Many denials occur when services are billed under the wrong claim type. For example, outpatient procedures billed incorrectly under facility logic can cause payment delays even if the clinical care was correct.

The CMS 1500 form is divided into logical field groups. Understanding these groups matters more than memorizing box numbers.

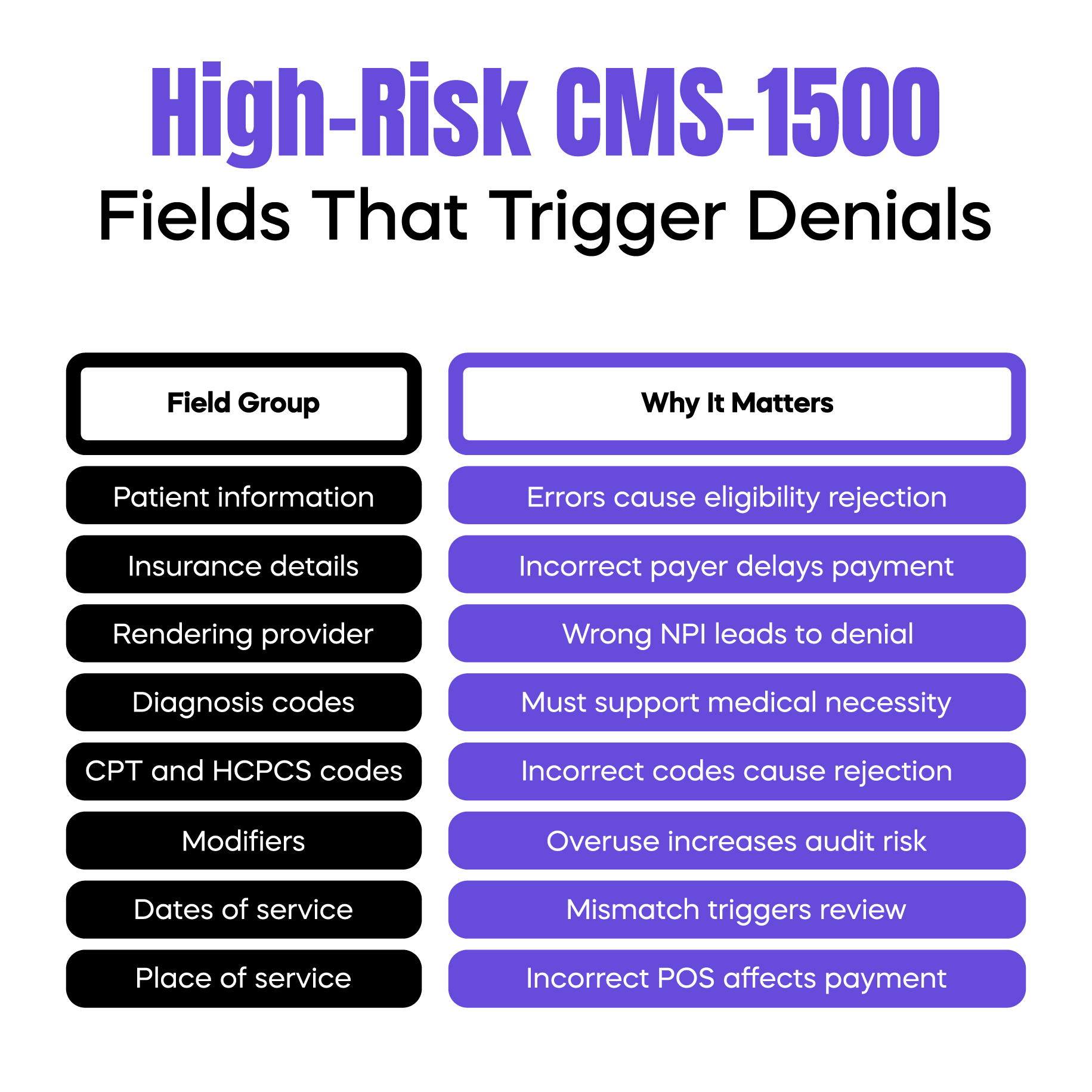

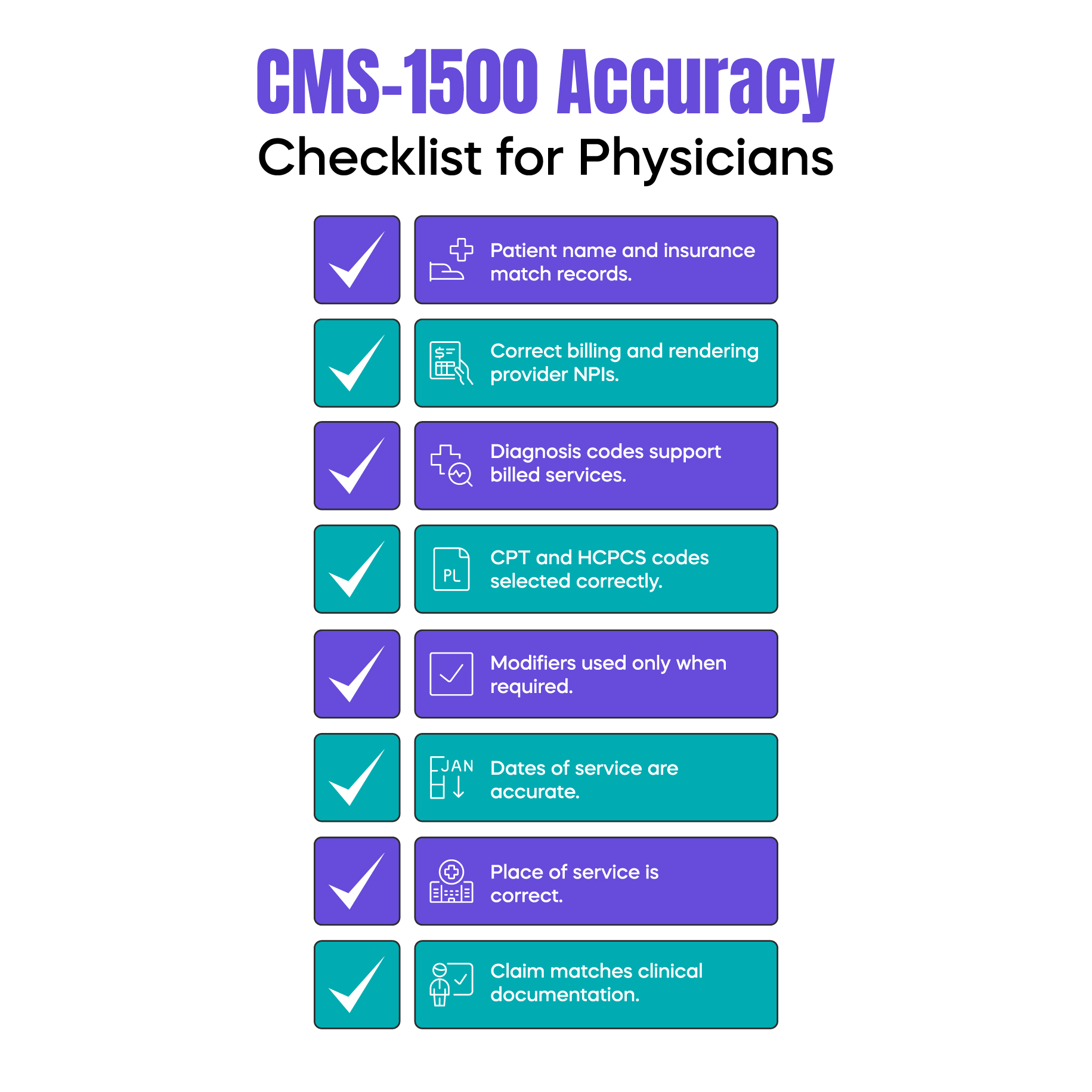

The first group captures patient and insurance information. Errors here often cause eligibility rejections or coordination of benefits delays.

The next group captures provider information. This includes the billing provider, rendering provider, and service location. A common real-world issue occurs when EHRs auto-populate the billing provider correctly but pull the wrong rendering provider, triggering payer reviews.

Another critical group links diagnosis codes to procedure codes. This is where medical necessity is evaluated. If the ICD-10-CM code does not support the CPT code, the claim may be denied even if documentation exists.

Modifiers appear in this same section. Incorrect modifier placement or overuse is one of the fastest ways to trigger audits, especially for evaluation and management services.

The final groups capture charges, dates of service, and signatures. Missing or inconsistent dates often lead to manual payer review.

Accurate CMS 1500 completion affects more than payment speed. It directly impacts revenue stability and compliance risk.

When claims are filled correctly, they pass payer edits quickly and move into adjudication without manual review. When small inconsistencies appear, payers often suspend claims for review. This can delay payment by weeks.

In real practice settings, we often see physicians paid initially, only to receive refund requests months later. These recoupments usually trace back to CMS 1500 data that did not align with documentation standards, even though the clinical care was appropriate.

The CMS 1500 also plays a role in audits. Payers and Medicare contractors review claim data first. Documentation is requested only after the claim triggers concern. Clean data reduces audit exposure.

Some CMS 1500 errors appear repeatedly across practices.

Diagnosis and procedure mismatches are common. The physician documents the correct condition, but the wrong ICD-10-CM code is linked to the CPT code on the claim. Payers evaluate medical necessity using the claim, not the note.

Modifier misuse is another frequent issue. Modifier 25, modifier 59, and X modifiers are often applied correctly from a clinical standpoint but incorrectly from a billing standpoint. Overuse patterns attract payer attention.

Provider information errors also cause problems. Claims may list the correct billing entity but an outdated rendering provider NPI. This often happens when staff rely on default EHR settings.

These mistakes are rarely intentional. They are workflow issues, not clinical ones.

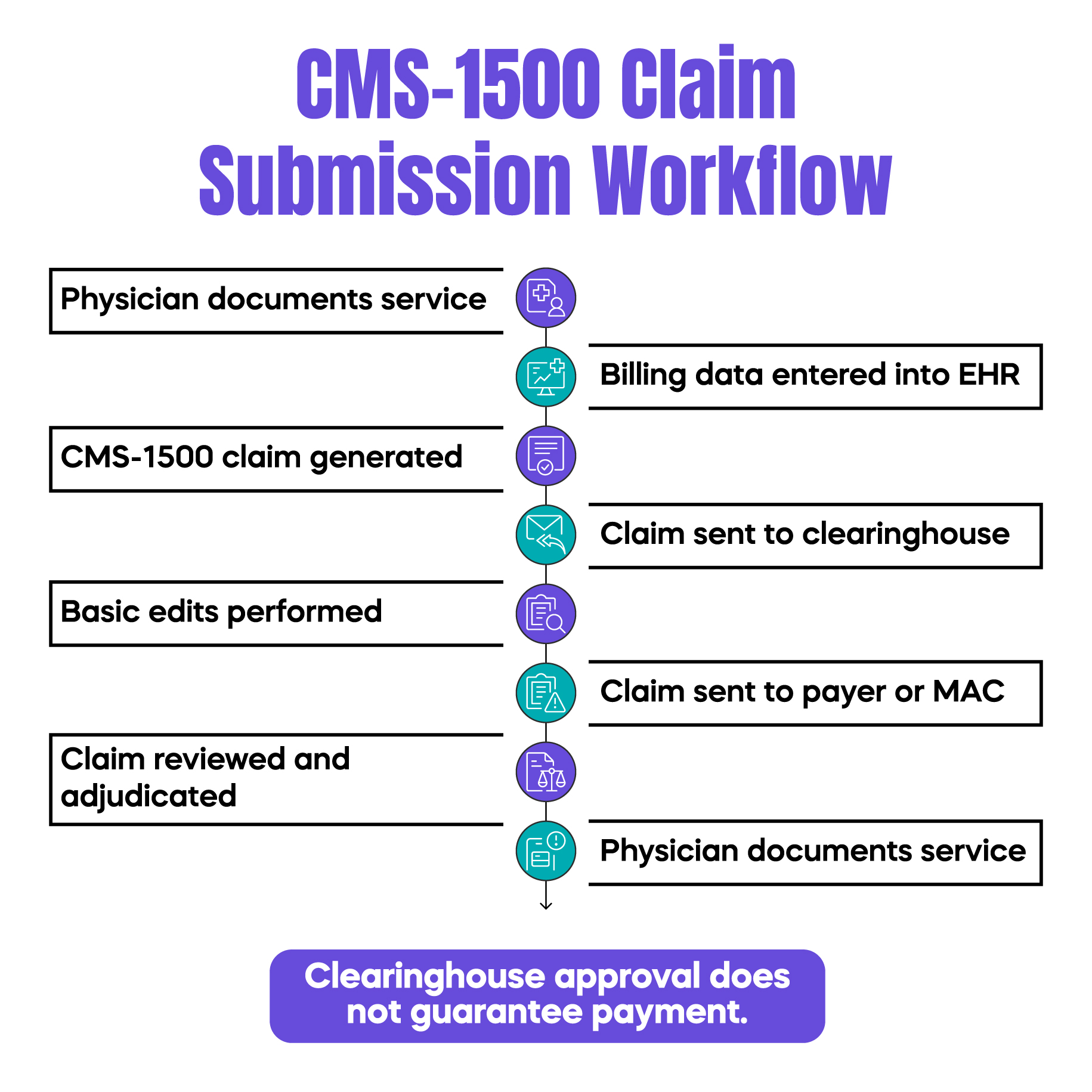

Today, most CMS 1500 claims are submitted electronically. The CMS-1500P format allows digital transmission through EHR systems and billing platforms.

Even though the process feels automated, the same CMS 1500 rules apply. Data is still mapped into the CMS 1500 structure before reaching the payer.

A common misconception is that electronic submission prevents errors. In reality, EHR automation can hide errors until claims are denied. Auto-filled fields may not reflect the actual service performed or the provider involved.

Understanding the CMS 1500 structure helps physicians identify where technology supports billing and where it creates silent risk.

Clearinghouses act as intermediaries between medical practices and payers. They receive CMS 1500 claims, run basic edits, and forward accepted claims to Medicare or commercial insurers.

Clearinghouses catch formatting errors and missing required fields. They do not verify medical necessity or documentation accuracy. A claim can pass clearinghouse edits and still be denied or audited by the payer.

Many physicians believe clearinghouse acceptance equals claim safety. This is not true. Clearinghouses validate structure, not compliance.

CMS 1500 data plays a major role in compliance reviews. Medicare Administrative Contractors analyze claim patterns before requesting records.

Repeated use of certain modifiers, high-level evaluation codes, or unusual diagnosis combinations often triggers review. These patterns are visible in CMS 1500 data long before documentation is examined.

Practices that outsource billing are not immune. The physician remains responsible for what is submitted under their NPI. Understanding CMS 1500 basics helps physicians ask better questions and identify risks early.

Arj Fatima is a U.S. medical billing content specialist with hands-on experience analyzing physician claim workflows, denial patterns, and compliance risks. Her work focuses on translating complex billing rules into clear, practical guidance for doctors and practice owners. She writes exclusively on real-world billing behavior observed across outpatient practices, helping physicians protect revenue while staying compliant with CMS and payer requirements.

© Billing MedTech. All Rights Reserved