Are you ready to grow up your business? Contact Us

Call us anytime

Are you ready to grow up your business? Contact Us

Most doctors do not wake up worried about committing CMS billing violations. They worry about patient care, staff shortages, packed schedules, and keeping the practice running. Billing often feels secondary. Unfortunately, CMS does not see it that way.

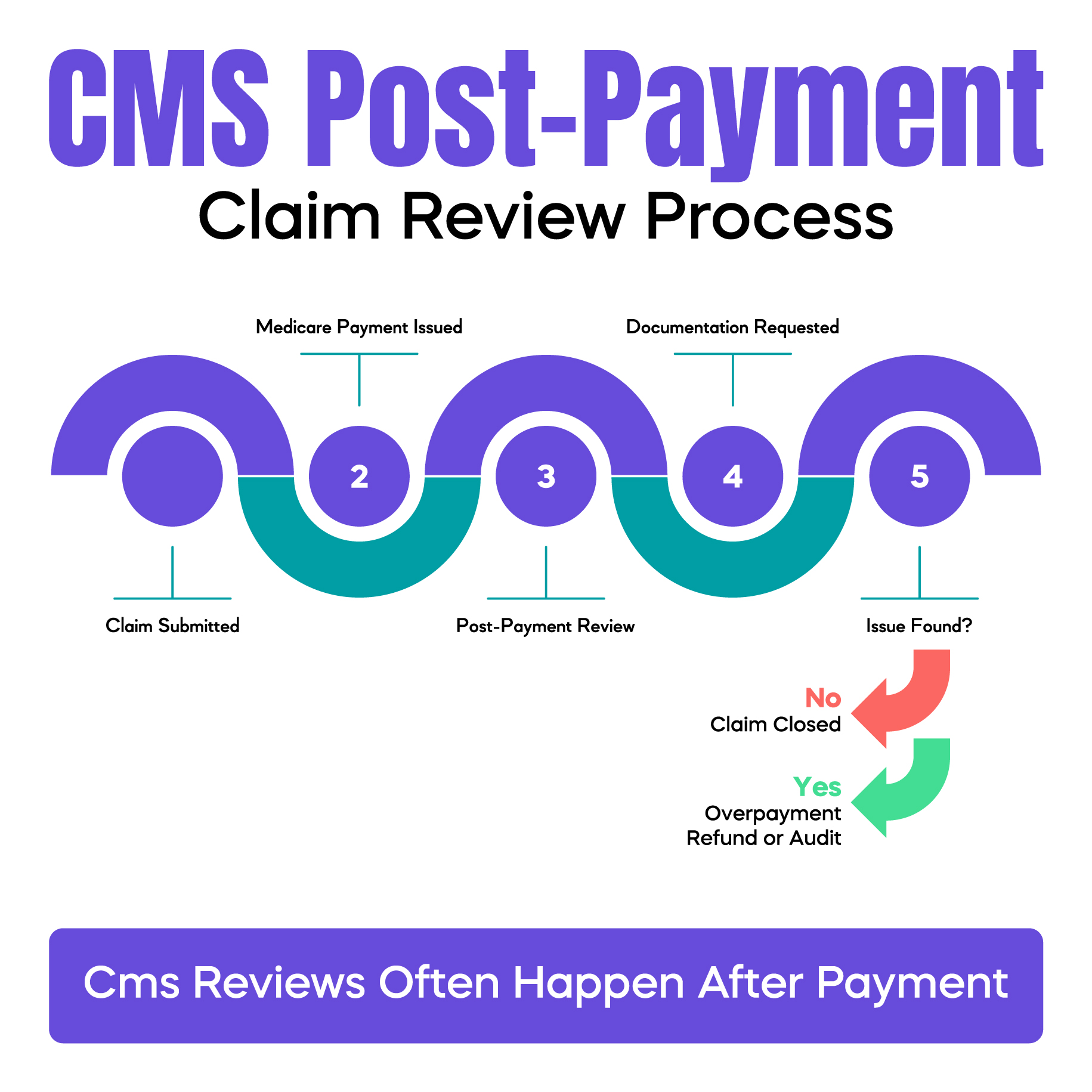

Many CMS billing violations do not start with fraud or intent. They start with small, routine habits. A copied note that was never updated. A modifier added “just in case.” A level of service chosen based on time pressure instead of documentation. These mistakes often go unnoticed because the claim gets paid. Months later, the payment is reviewed. Then comes the refund request, the audit letter, or the compliance inquiry.

This is what frustrates physicians most. You do the work. You get paid. Then CMS comes back and says the payment was wrong.

This article explains common CMS billing violations in clear, practical terms. It focuses on why they happen in real practices and how doctors can avoid them before they turn into audits, penalties, or revenue loss.

CMS billing violations occur when a claim submitted to Medicare does not meet CMS rules. These rules apply to coding, documentation, medical necessity, and billing behavior. A violation does not require intent. CMS looks at what was billed and what was documented, not why it happened.

CMS uses CPT codes to describe services. ICD-10-CM codes explain diagnoses. HCPCS codes cover supplies and special services. All of this information flows through the CMS-1500 claim form or its electronic version. If any part does not match CMS requirements, it can be flagged as a violation.

Many doctors assume billing violations only apply to fraud cases. That is incorrect. Simple documentation gaps, incorrect modifiers, or outdated coding habits can all count as CMS billing violations, even when care was appropriate and necessary.

Most CMS billing violations come from workflow pressure, not bad intent. Physicians are expected to see more patients in less time. Notes are completed quickly. Templates are reused. Staff rely on old rules that no longer apply.

Electronic health record systems add another layer of risk. Auto-populated fields can create documentation that looks complete but does not actually support the service billed. Copy-and-paste notes often repeat exam findings that were not performed that day. CMS auditors notice these patterns.

Staff turnover also plays a role. New billers may not fully understand payer-specific rules. Medicare Administrative Contractors, known as MACs, apply local coverage determinations differently. What was accepted last year may be denied today.

These are not rare situations. They are daily realities in U.S. medical practices.

Choosing the wrong CPT code is one of the most common CMS billing violations. This often happens with evaluation and management services. Doctors select a higher-level code based on complexity or time pressure, but the documentation does not support it.

CMS expects the note to clearly reflect the level billed. When the documentation looks similar across visits but the code changes, auditors question the accuracy.

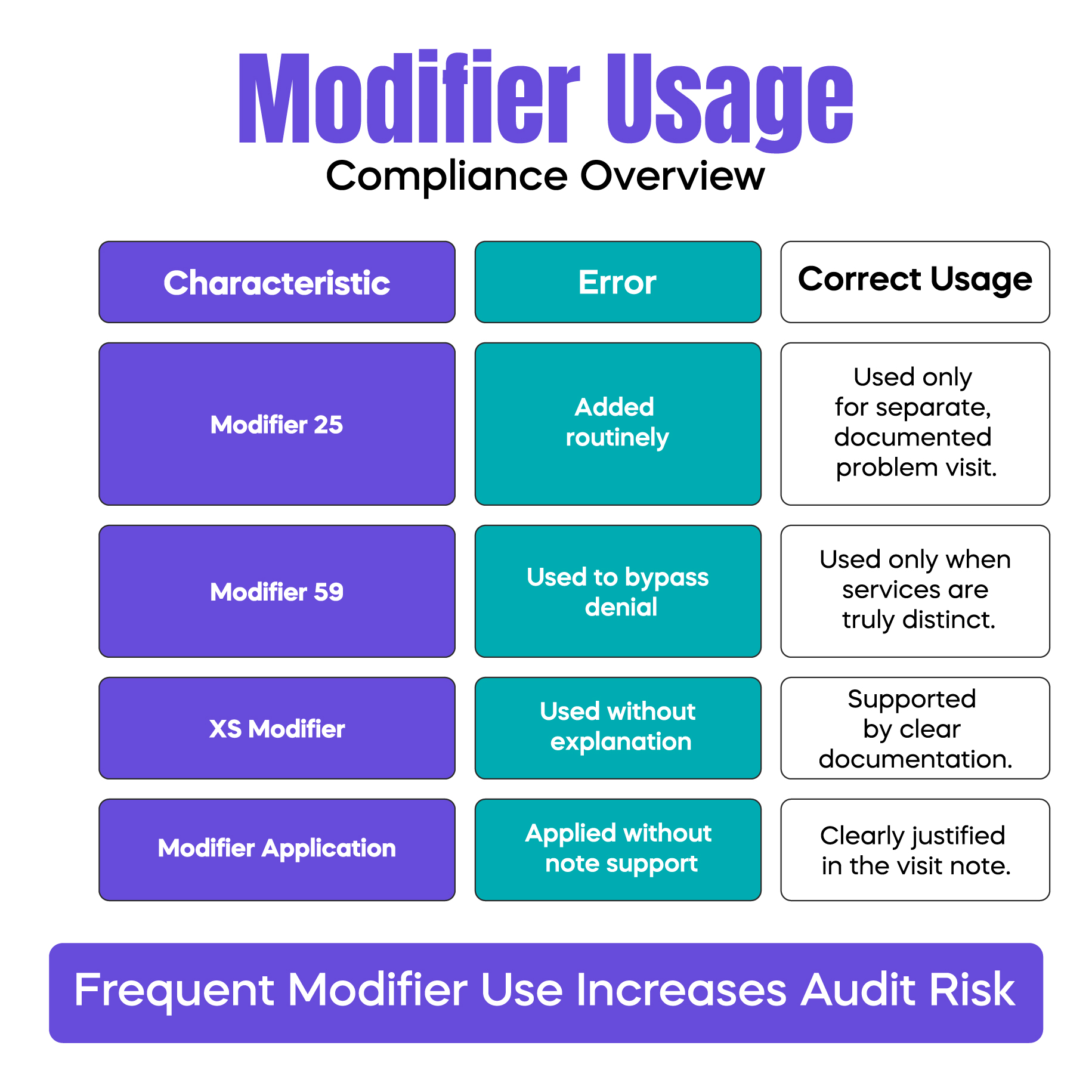

Modifiers are meant to explain special circumstances. They are not tools to force payment. Modifier 25 is frequently overused when a problem-oriented visit is billed with a preventive service. Modifier 59 and XS are often added to bypass bundling edits without proper justification.

CMS pays close attention to modifier patterns. When a modifier appears on most claims, it raises red flags.

Medical necessity is not implied. It must be clearly documented. CMS uses local coverage determinations and national coverage determinations to define what is considered reasonable and necessary.

A service can be performed correctly and still be denied if the reason for the service is not clearly documented. This is a major source of post-payment reviews.

Unbundling occurs when services that should be billed together are billed separately. This often happens when practices follow outdated billing habits or misunderstand bundled codes.

CMS views unbundling as a serious billing violation because it directly affects reimbursement accuracy.

If a service is not documented, CMS considers it not performed. This includes procedures, counseling time, and elements of high-level visits. Auditors do not assume. They verify.

CMS does not audit randomly. Audits are driven by patterns. Repeated high-level E/M codes. Frequent modifier use. Billing behavior that differs from peers in the same specialty.

Overpayments also trigger audits. When CMS identifies multiple claims with similar issues, it may expand the review period. What starts as a small refund request can turn into a full audit covering months or years.

This is why small errors matter. They rarely stay small.

CMS uses advanced data analysis. Claims are compared across providers, specialties, and regions. MACs look for outliers. Patient complaints are also reviewed.

Importantly, many CMS billing violations are identified after payment. Doctors assume paid claims are safe. They are not. Post-payment reviews are common and often more detailed.

CMS billing violations can lead to overpayment refunds, payment delays, and increased audit frequency. In some cases, practices must enter corrective action plans.

Even when penalties are financial, the administrative burden is heavy. Staff time is pulled into record gathering. Physicians are distracted from patient care. Trust with payers can be damaged.

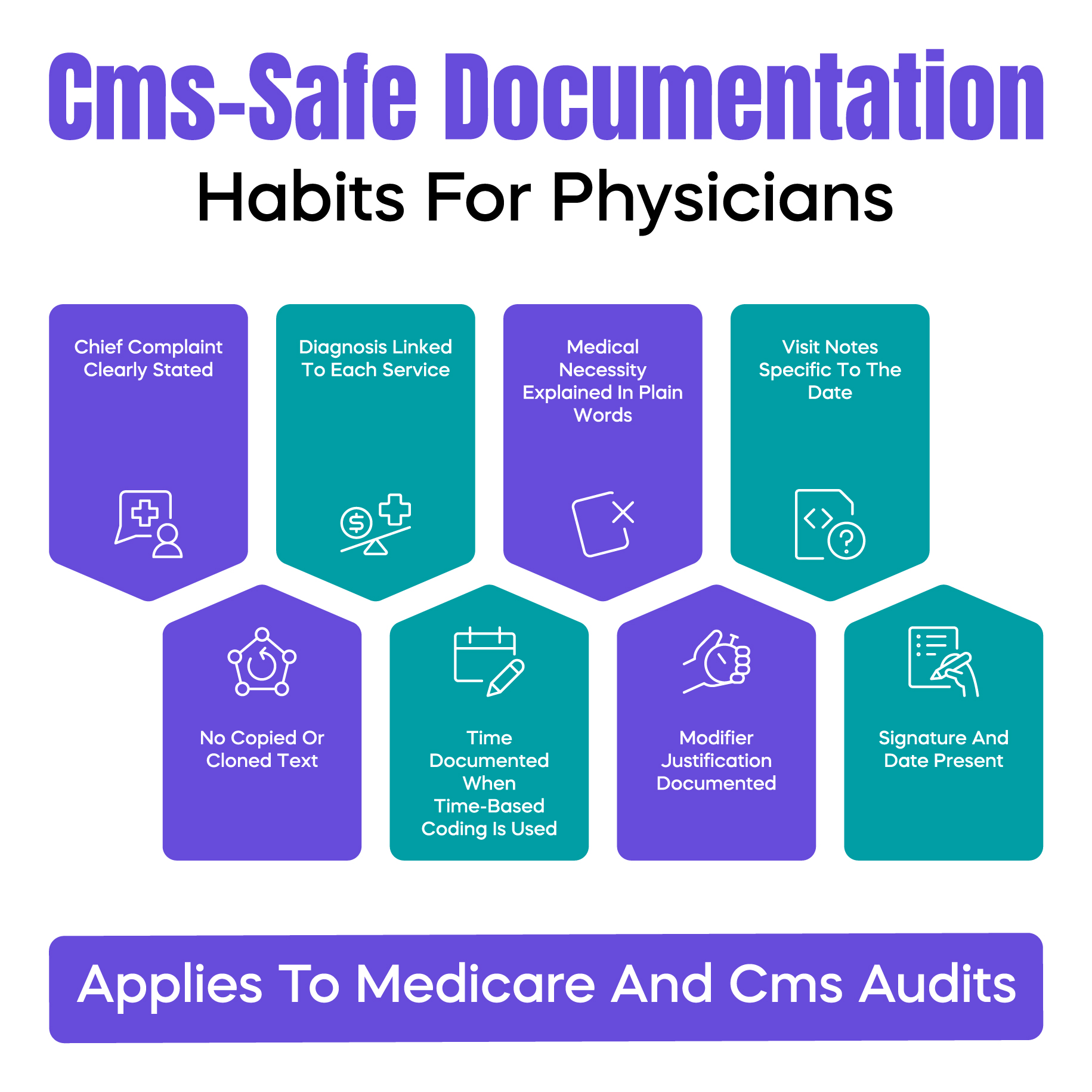

Avoiding CMS billing violations starts with habits, not software.

Documentation should clearly explain why a service was needed. Notes should be specific to the visit, not copied forward. Modifiers should be used only when clearly justified.

Internal reviews help. Even a basic quarterly chart review can identify patterns before CMS does. Education matters too. Billing rules change. Old habits create new risk.

The best time to fix billing risk is before CMS contacts you. Practices that monitor trends, not just individual claims, are better protected.

Look for patterns. Are the same modifiers used repeatedly? Are most visits coded at the same level? These patterns attract attention.

Prevention is quieter, cheaper, and far less stressful than responding to an audit.

There is a point where internal fixes are not enough. When denial trends rise or refund requests increase, outside billing support can help identify blind spots.

The goal is not to outsource responsibility. It is strengthening compliance so physicians can focus on care without constant billing anxiety.

Arj Fatima is a senior U.S. medical billing and compliance content specialist with hands-on experience working with Medicare billing workflows, CMS audits, and revenue cycle risk management. She has helped physician practices identify documentation gaps, reduce denial trends, and correct billing patterns before they triggered audits. Her writing focuses on practical, real-world guidance that helps doctors protect revenue while staying compliant with evolving CMS rules.

© Billing MedTech. All Rights Reserved