Are you ready to grow up your business? Contact Us

Call us anytime

Are you ready to grow up your business? Contact Us

Running a high-volume urgent care center is not easy. Patient flow is constant. Visits are short. Documentation happens fast. Billing errors happen faster.

Many urgent care owners see more patients every year, yet revenue does not grow at the same pace. In some cases, it drops. Claims get denied. Payments come back lower than expected. Accounts receivable keep climbing.

High-volume urgent care billing magnifies small mistakes. A missing modifier. A wrong place of service code. Incomplete documentation. When these issues repeat across dozens or hundreds of visits, revenue loss adds up quickly.

This guide explains urgent care billing in clear, simple language. It focuses on real operational problems seen in U.S. urgent care clinics. You will learn where billing breaks down, why denials happen, and how to manage billing accurately without slowing patient flow.

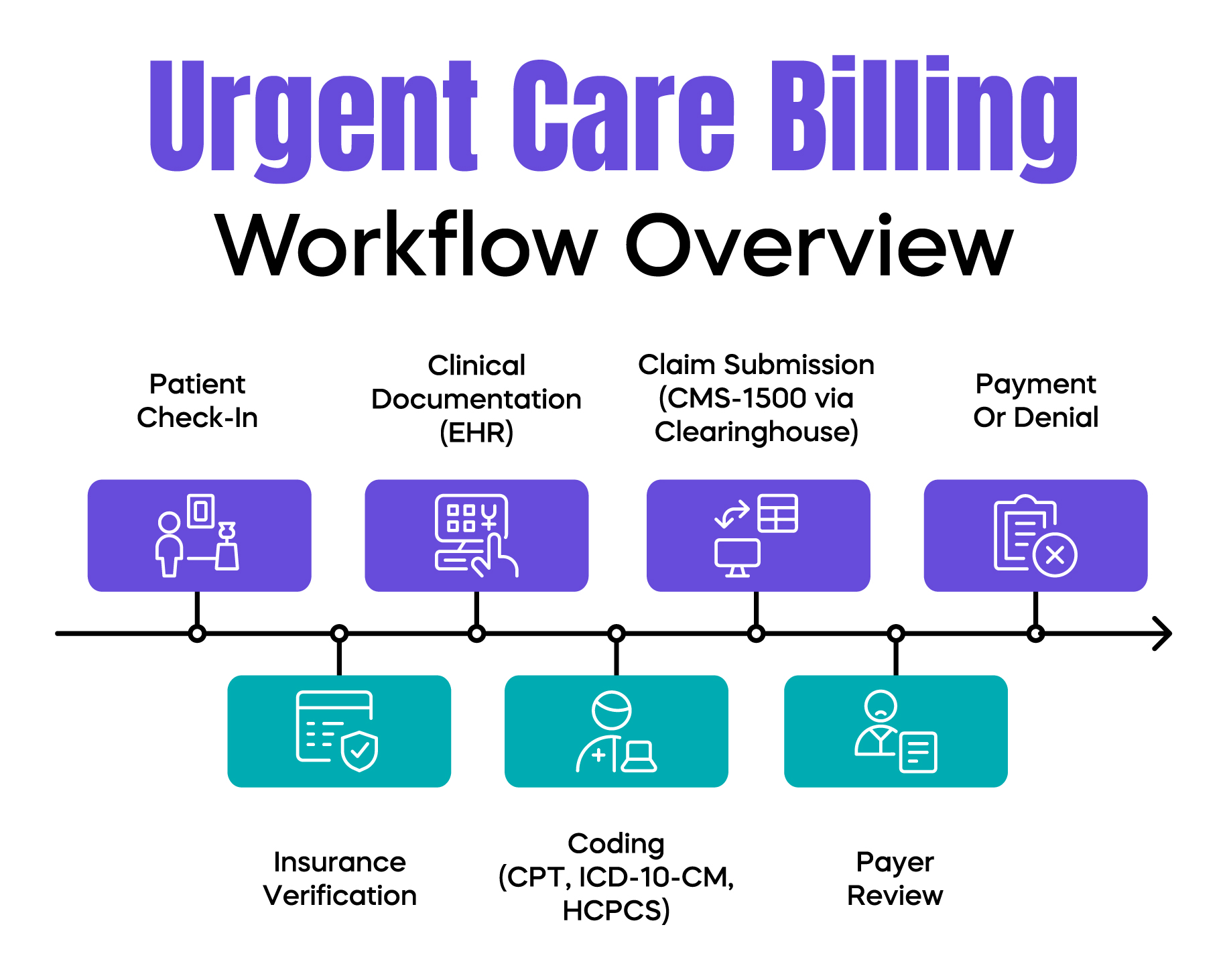

Urgent care billing is the process of turning patient visits into paid claims. It follows the same basic structure as other outpatient billing, but the speed and volume make it far more complex.

Urgent care billing includes patient registration, coding, claim submission, payment posting, and denial management. Most claims are submitted on the CMS-1500 form through a clearinghouse. Codes must accurately reflect what happened during the visit and why it was medically necessary.

Urgent care clinics rely heavily on CPT codes for evaluation and management services, ICD-10-CM codes for diagnoses, and HCPCS codes for supplies and tests. These codes are reviewed by Medicare, Medicaid, and commercial payers under strict rules.

What makes urgent care different is volume. Providers move quickly. Staff rotate often. Documentation is done under pressure. These conditions increase risk at every billing step.

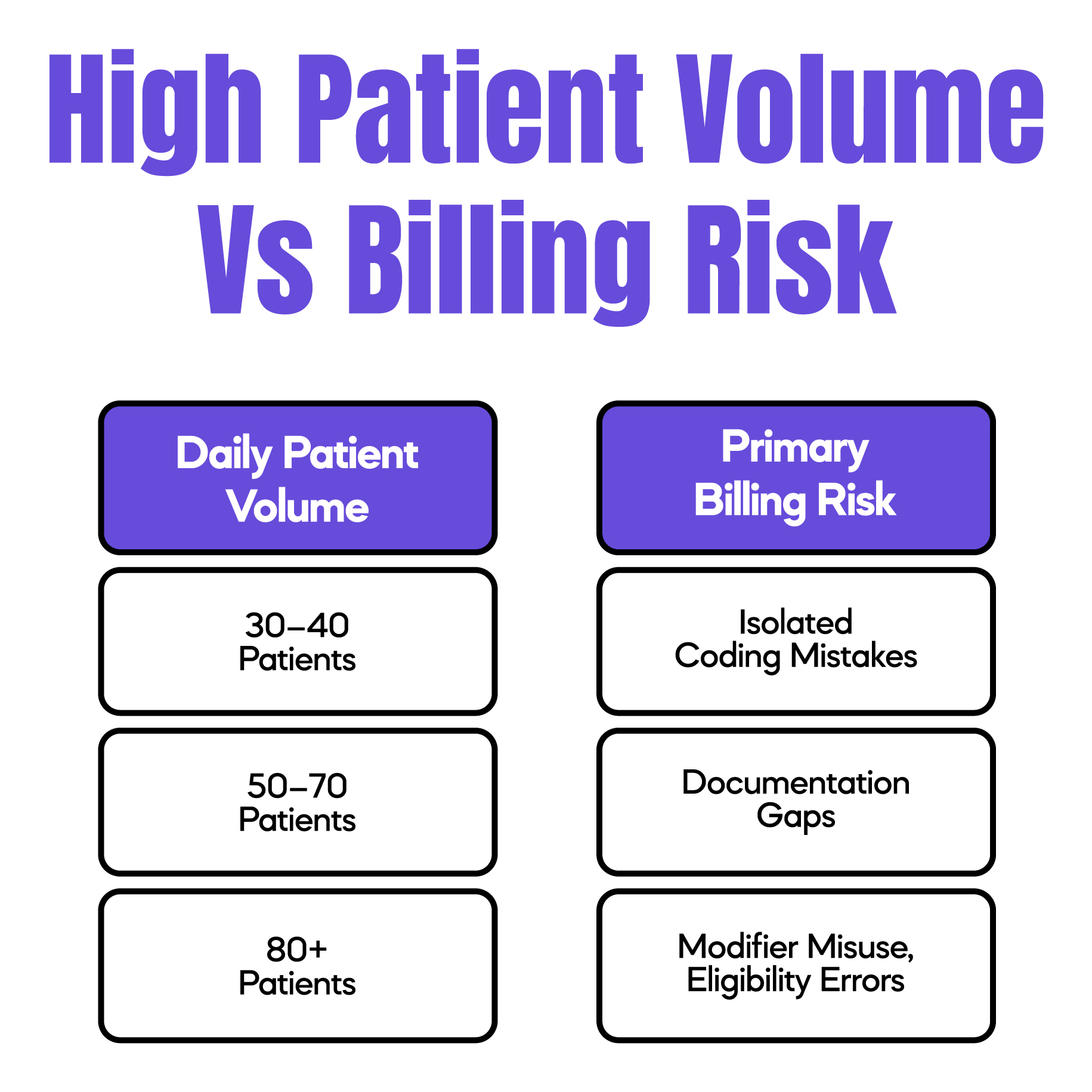

High patient volume creates stress across the entire revenue cycle. When clinics see 60, 80, or even 120 patients per day, accuracy often suffers.

Front desk staff rush check-ins. Insurance details are entered incorrectly. Secondary coverage is missed. Providers rely on templates to save time. Coding decisions are made quickly, sometimes without full documentation support.

These small issues do not always show up immediately. Claims may pass clearinghouse edits but fail payer review. Denials appear weeks later, long after the visit is forgotten.

In urgent care operations, we often see denial spikes after weekends, holidays, or flu season surges. Volume goes up, but billing controls stay the same. That mismatch leads to lost revenue.

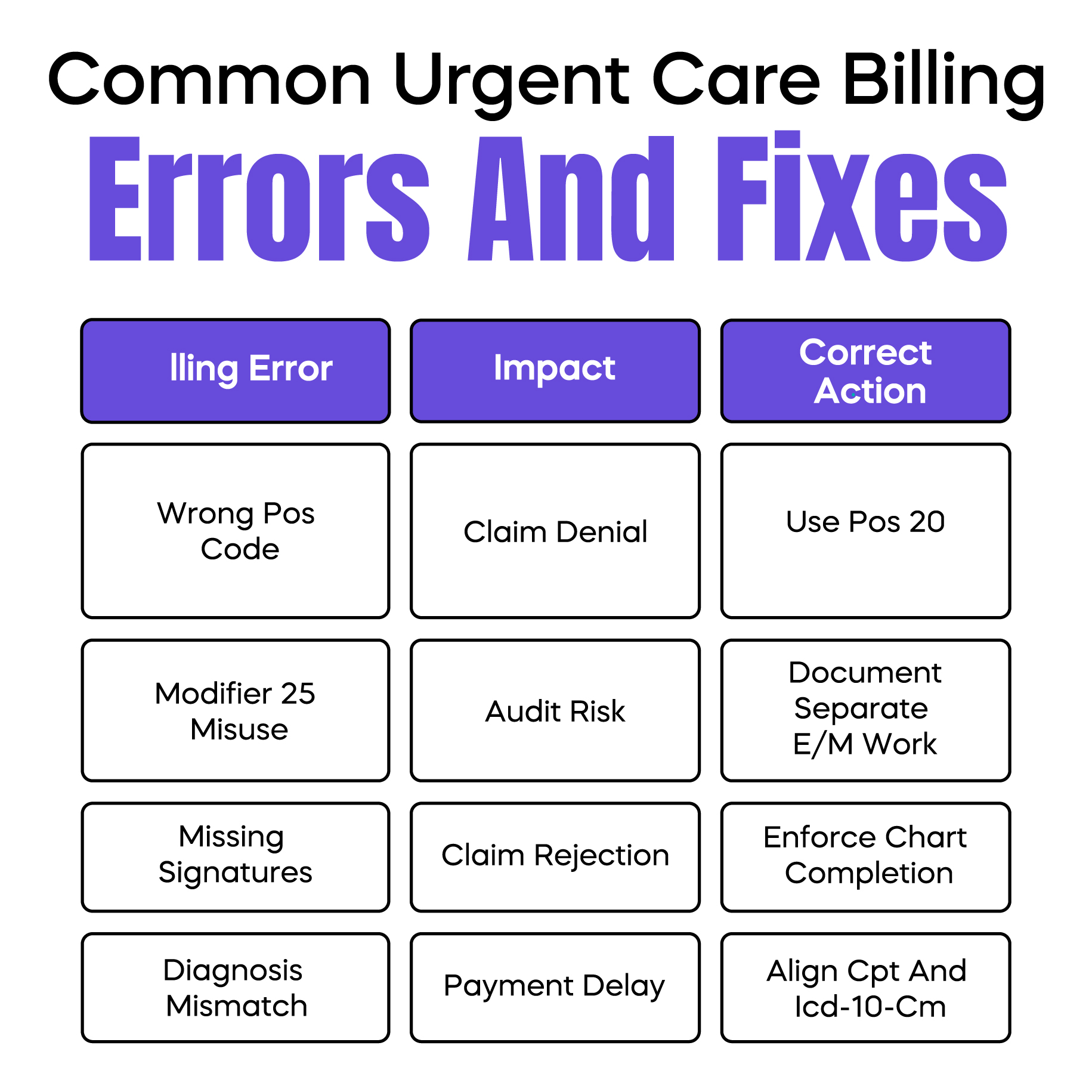

Certain billing errors appear repeatedly in urgent care clinics.

One of the most common is using the wrong place of service code. Urgent care centers must bill POS 20. When POS 11 is used by mistake, payers may deny the claim or reduce reimbursement.

Modifier misuse is another major issue. Modifier 25 is frequently required when a procedure and an evaluation and management service occur on the same day. In high-volume settings, this modifier is often added automatically without proper documentation support. This increases audit risk.

Documentation gaps also cause denials. Missing provider signatures, incomplete histories, or unclear medical decision-making are common problems. These issues are harder to fix after the fact.

Clearinghouse rejections add another layer of confusion. A rejection means the claim never reached the payer, often due to formatting or missing data. These must be corrected immediately to avoid delays.

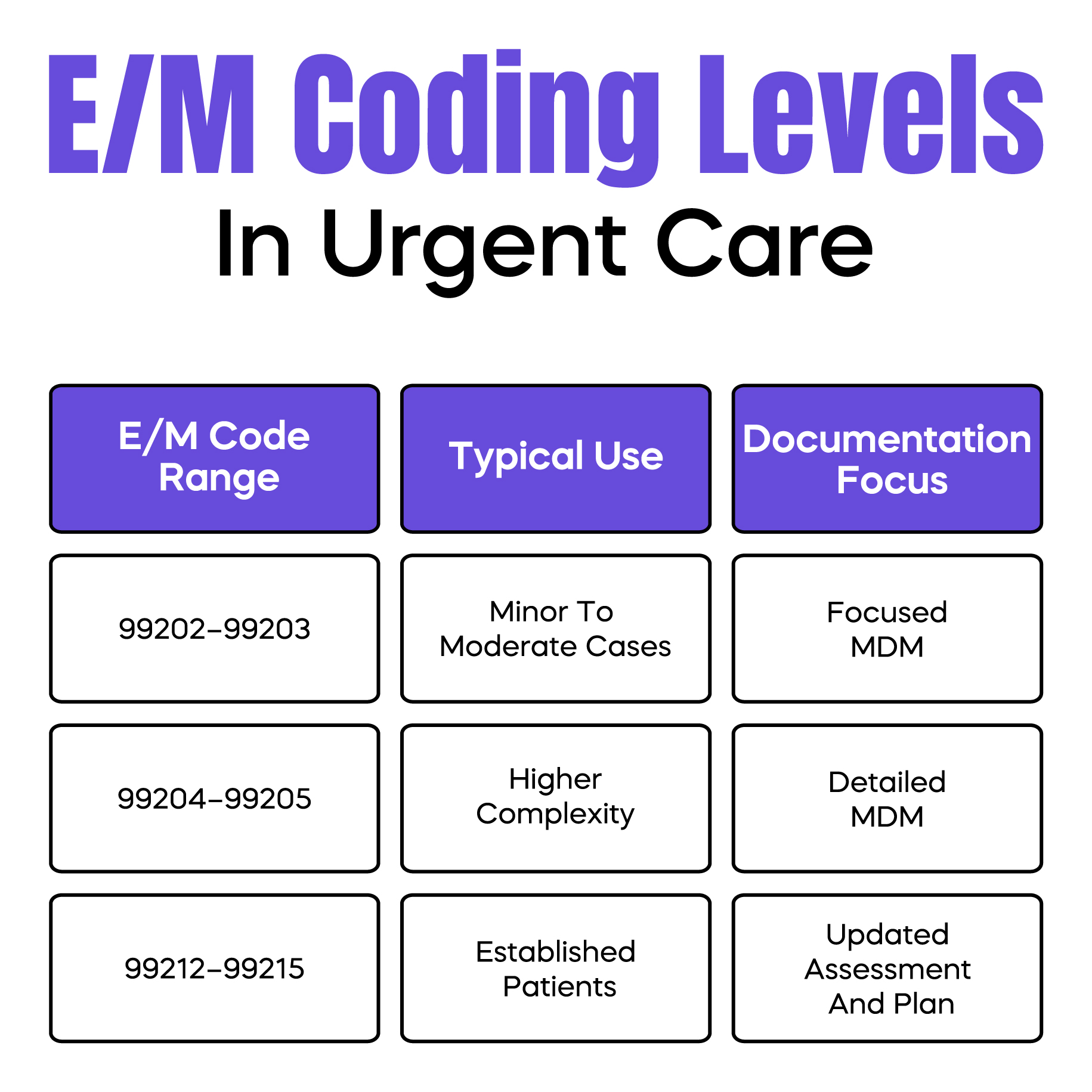

Urgent care clinics commonly bill CPT codes 99202 through 99205 for new patients and 99212 through 99215 for established patients. These codes are based on medical decision-making or total time spent on the date of service.

In high-volume clinics, providers often default to a single code level to save time. This creates two risks. Under-coding reduces revenue. Over-coding increases audit exposure.

Another frequent problem is weak documentation. Templates are helpful, but cloned notes that look identical across visits raise red flags during audits. Payers expect documentation to reflect the unique details of each encounter.

Coding errors are rarely intentional. They are usually the result of speed, fatigue, and unclear guidance.

Strong documentation is the foundation of clean urgent care billing. Payers do not see patient volume. They only see what is written in the chart.

Documentation must clearly explain why the patient came in, what was evaluated, what decisions were made, and what treatment was provided. If a procedure is billed, the documentation must support it separately from the evaluation service.

EHR systems make documentation faster, but they also create risk. Overused macros and copied notes reduce credibility. During audits, Medicare Administrative Contractors review patterns, not just individual claims.

Clear documentation protects clinics from takebacks and repayment demands.

Urgent care billing problems often start at the front desk. Incorrect insurance information can doom a claim before the provider enters the exam room.

Common front-end errors include wrong payer order, missing group numbers, and failure to identify self-pay patients correctly. These mistakes lead to denials that billing teams cannot fix without patient follow-up.

Real-time eligibility tools help reduce these errors. However, tools only work if staff use them consistently, even during peak hours.

Front desk accuracy directly affects collections, denial rates, and patient satisfaction.

Urgent care claims face higher scrutiny because payers see them as high-frequency, low-complexity services. This assumption is not always fair, but it shapes payer behavior.

Medicare reviews medical necessity closely. Commercial payers often apply frequency edits. Medicaid rules vary by state and managed care plan.

Claims are commonly denied for insufficient documentation, diagnosis mismatches, or incorrect coding combinations. These denials increase during high-volume periods when errors repeat.

Understanding denial patterns helps clinics fix root causes instead of chasing individual claims.

Revenue cycle management in urgent care must move fast. Monthly reviews are not enough. By the time issues appear, hundreds of claims may be affected.

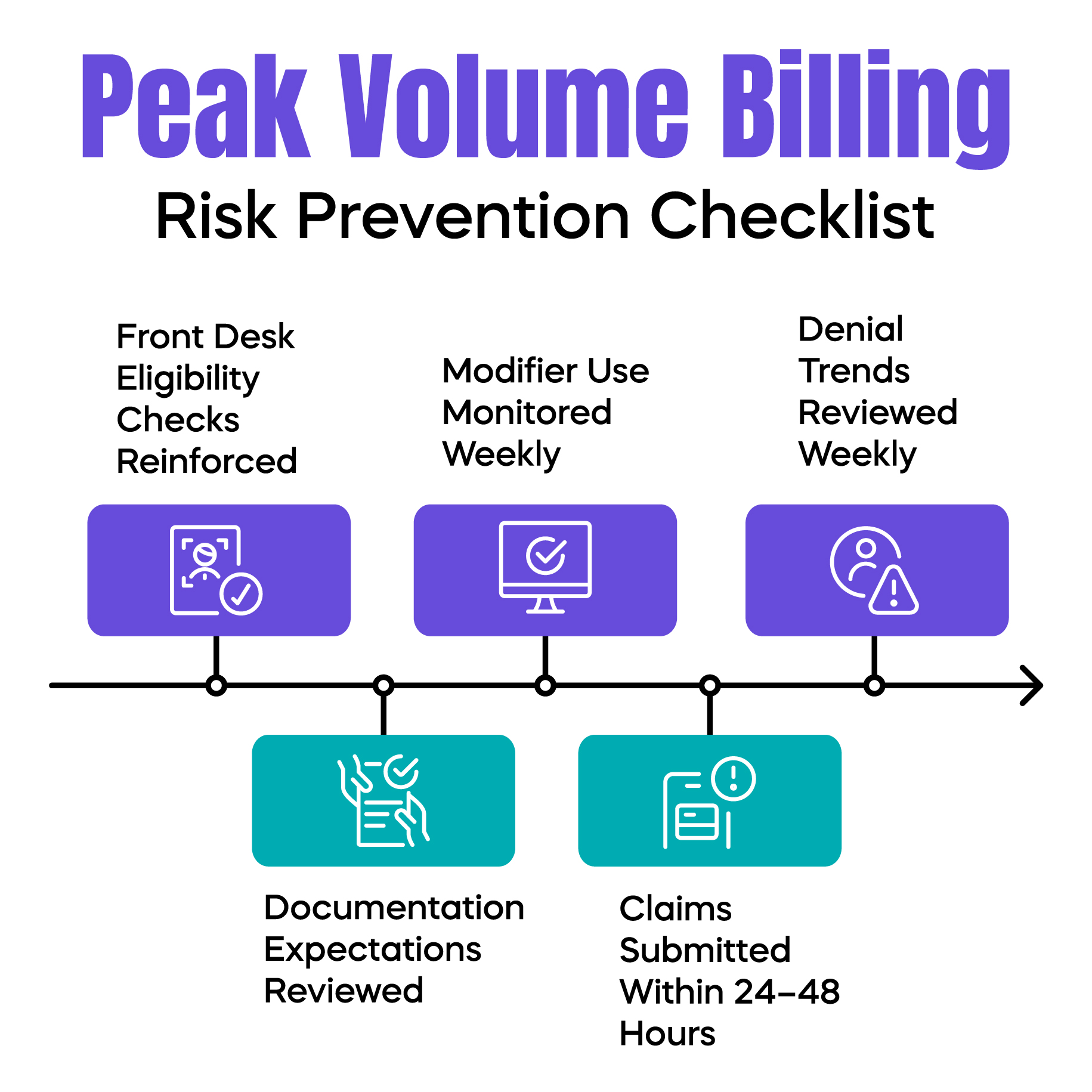

Effective urgent care RCM includes daily claim monitoring, weekly denial trend reviews, and rapid corrective action. Charge entry delays should be kept under 24 to 48 hours to protect cash flow.

Separating denial management from coding tasks often improves results. Each role requires focus, and mixing them slows both.

Peak periods expose weak billing systems. Clinics should prepare for flu season, weekends, and extended hours in advance.

Staff training should be refreshed before volume spikes. Documentation expectations should be reinforced. Front desk workflows should be simplified, not skipped.

Temporary volume increases should not mean permanent revenue loss.

High-volume urgent care billing is challenging, but it does not have to be chaotic. Most revenue loss comes from repeatable errors, not complex rules.

When clinics focus on documentation clarity, front-end accuracy, and proactive denial management, billing becomes predictable again. That stability allows urgent care owners to focus on patient care without constant revenue surprises.

For your convenience, we’ve created a printable, urgent care billing cheat sheet that consolidates the most commonly used E/M CPT codes, key HCPCS and S-codes, high-risk modifiers such as Modifier 25, POS 20 requirements, and essential documentation reminders. This quick reference is designed to support accurate high-volume claim submission, reduce preventable denials, and streamline daily coding decisions in fast-paced urgent care settings. You can download the cheat sheet below and keep it accessible at the front desk or billing department as a practical guide for consistent and compliant urgent care billing workflows.

Download the Urgent Care Billing Cheat Sheet (PDF)

Arj Fatima is a senior medical billing strategist with hands-on experience supporting U.S. urgent care clinics, primary care practices, and multi-provider groups. She specializes in high-volume billing workflows, denial reduction, and compliance-focused revenue cycle management. Arj has worked directly with billing teams and providers to resolve modifier misuse, documentation gaps, payer denials, and audit risks across Medicare, Medicaid, and commercial insurance plans.

© Billing MedTech. All Rights Reserved