Are you ready to grow up your business? Contact Us

Call us anytime

Are you ready to grow up your business? Contact Us

A CMS audit letter is never routine for a physician.

It creates stress, confusion, and financial anxiety. Most doctors read the notice once and still feel unsure what CMS is actually questioning. Revenue may already be at risk. Deadlines feel unclear. The language feels legal, not clinical.

Many physicians assume the billing team will handle it. Others delay action because patient care comes first. That delay often leads to missed appeal deadlines, automatic Medicare recoupment, or appeals that fail before they are fully reviewed.

The CMS audit appeal process is not designed for doctors. It is complex, time-sensitive, and heavily dependent on documentation. But when physicians understand how the process really works, they can make informed decisions. They can protect revenue, reduce compliance risk, and avoid repeating the same documentation patterns that trigger future audits.

This guide explains the CMS audit appeal process in plain language. It focuses on what physicians need to know, which decisions matter most, and where practices most often lose money.

A CMS audit is a review of Medicare claims that have already been paid. CMS is checking whether the services were billed correctly and supported by proper documentation.

The audit is not personal. It is data-driven. CMS looks for billing patterns such as frequent high-level E/M services, modifier use, repeated diagnoses, or services that exceed local utilization benchmarks.

Audits are conducted by Medicare Administrative Contractors (MACs). These contractors apply CMS rules, Local Coverage Determinations, and National Coverage Determinations when reviewing claims.

For physicians, the real risk is rarely a single denied claim. The risk is the pattern. Audit findings can affect future scrutiny, payment delays, audit frequency, and overall compliance exposure.

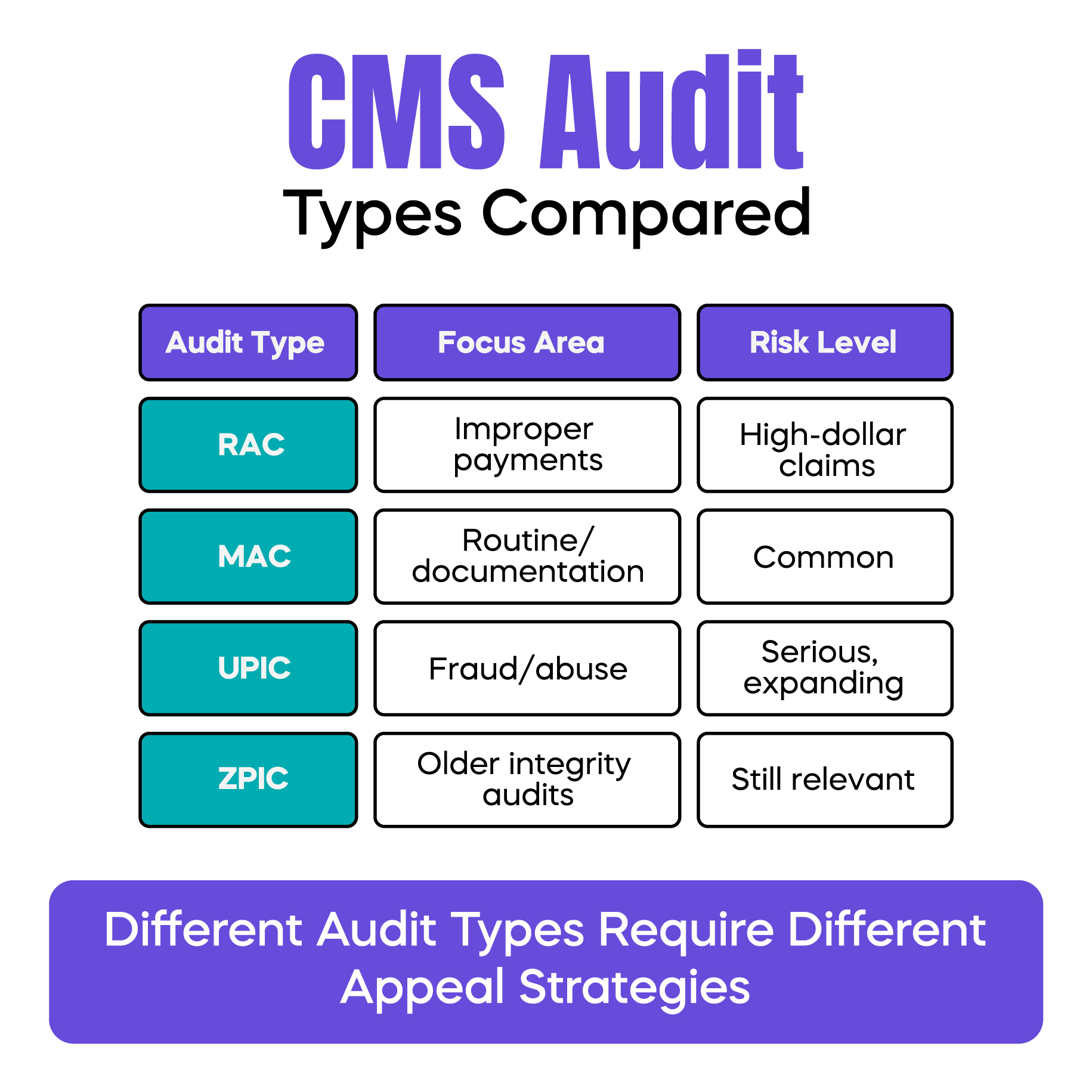

Most physicians encounter one of several CMS audit types.

Recovery Audit Contractors, or RACs, focus on identifying improper payments. These audits often target high-dollar services and known risk areas.

Medicare Administrative Contractors perform routine post-payment reviews. These audits are usually documentation-driven and common in everyday practice.

Unified Program Integrity Contractors, or UPICs, investigate potential fraud or abuse. These audits are more serious and often expand beyond the original claims.

Zone Program Integrity Contractors are older but still appear in some audit cases.

Each audit type behaves differently. RAC audits often feel automated. UPIC audits feel investigative. Understanding who initiated the audit helps guide the appeal strategy and risk assessment.

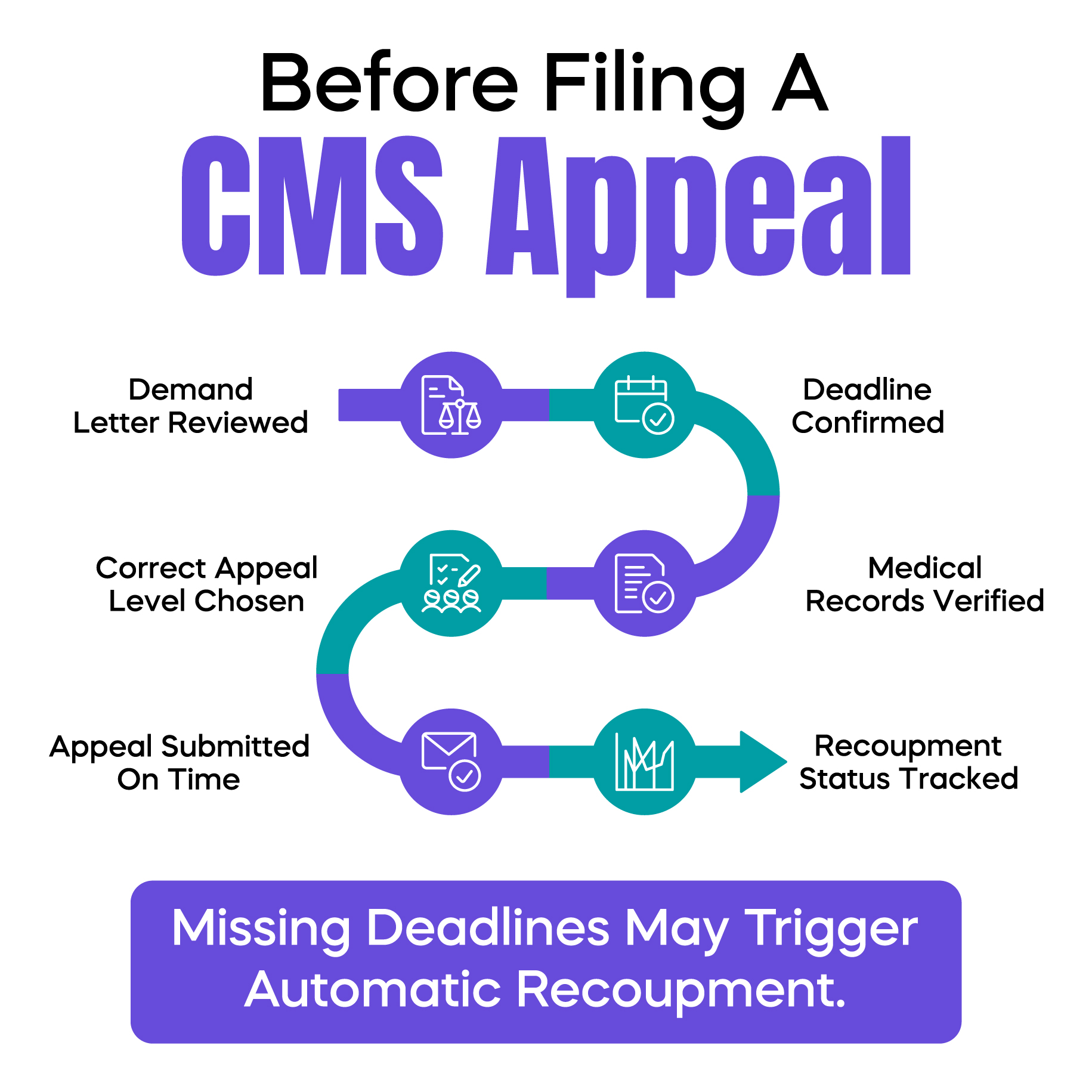

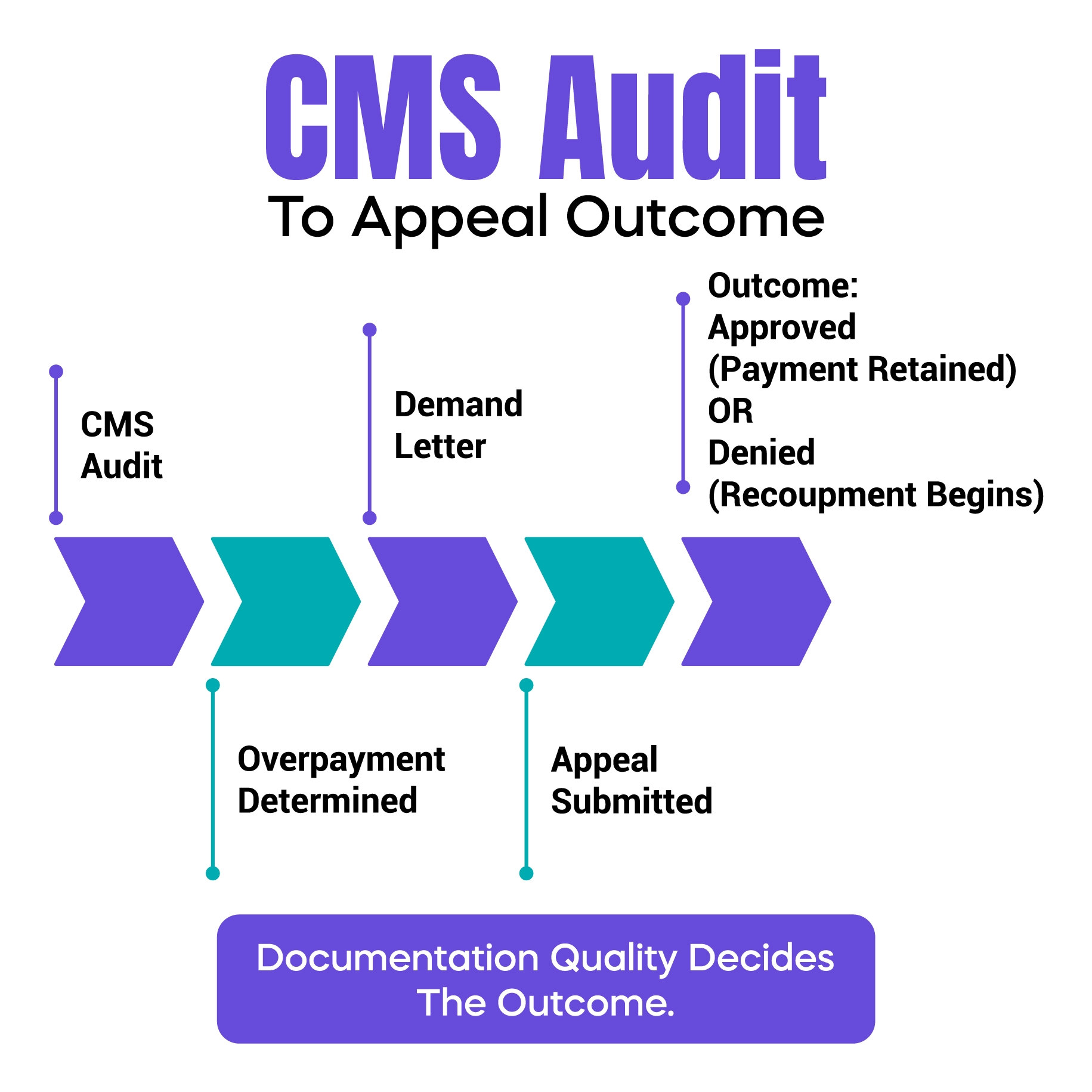

A Medicare demand letter is often the starting point of the appeal process. It states that CMS believes an overpayment occurred and requests repayment.

This letter is time-sensitive. Ignoring it does not pause the process. It accelerates it.

Physicians should immediately focus on three items. The deadline is stated in the letter. The amount CMS plans to recoup. And whether the findings relate to coding, documentation, or medical necessity.

At this stage, many practices panic and refund the amount. Others wait too long, assuming clarification will come later. Both actions can be costly.

This is the moment to decide whether an appeal is appropriate. That decision should be based on documentation strength and medical necessity support, not fear or frustration.

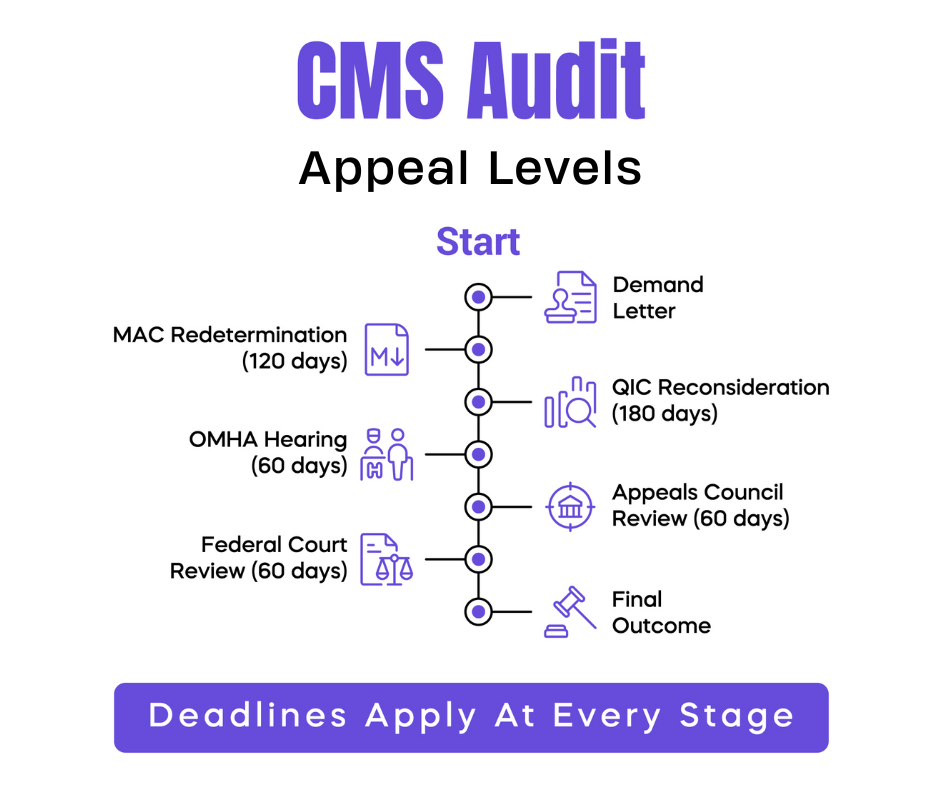

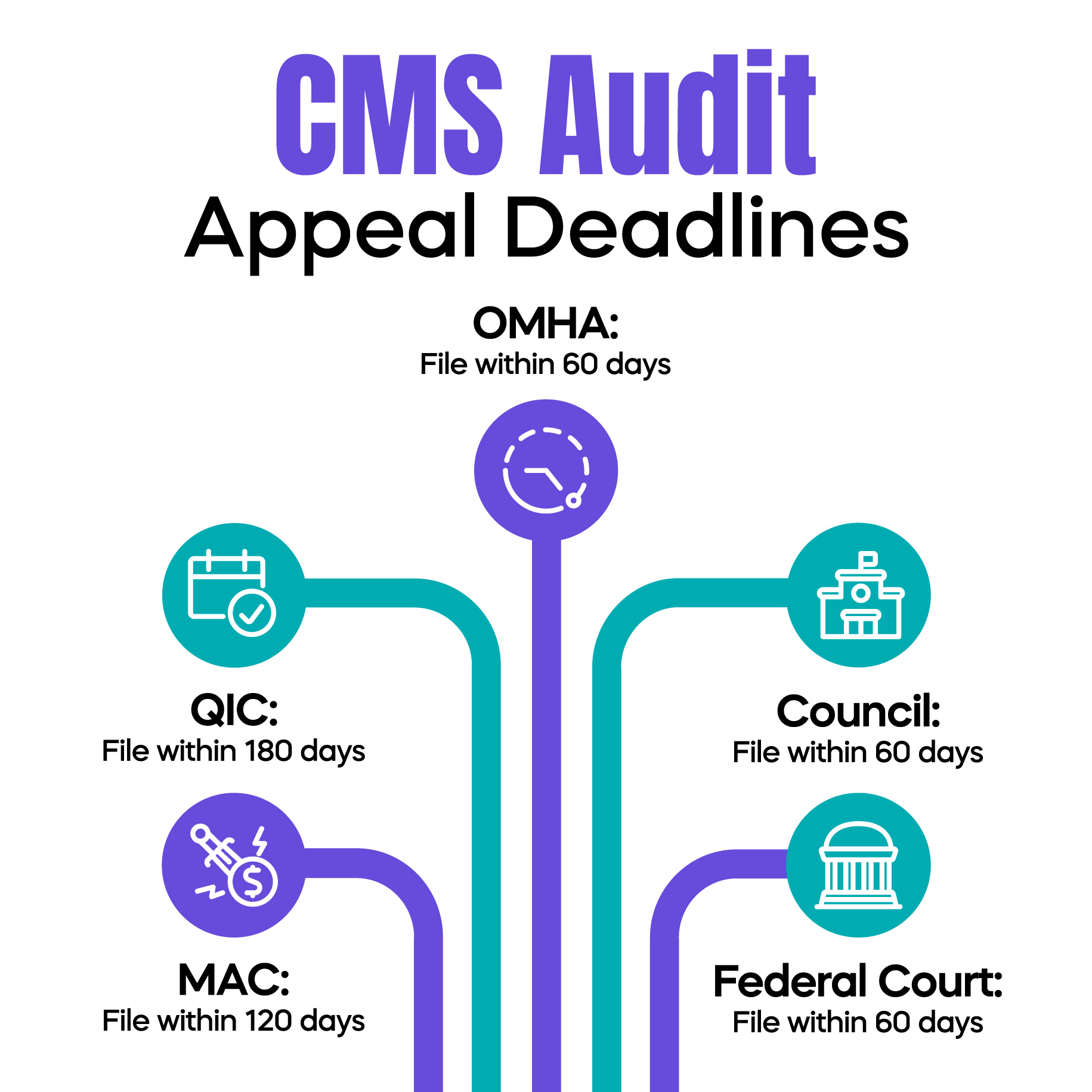

The CMS audit appeal process includes five levels. Each level has strict deadlines and different reviewers.

The first level is redetermination by the MAC. Physicians must request this within 120 days of the initial determination. This is a paper review conducted by the same MAC that processed the claim. Most failures at this stage occur due to unclear or incomplete documentation rather than incorrect coding.

The second level is reconsideration by a Qualified Independent Contractor, or QIC. Physicians must file within 180 days of the MAC decision. This level focuses heavily on medical necessity and whether documentation supports the billed CPT code. Appeals often fail here when assessment and plan details do not clearly justify the service level.

The third level is a hearing with the Office of Medicare Hearings and Appeals. Physicians must request this within 60 days of the QIC decision. An Administrative Law Judge reviews the case, and physicians may testify or appoint a representative. This level allows more context but involves longer timelines.

The fourth level is reviewed by the Medicare Appeals Council. Physicians must file within 60 days of the ALJ decision. The Council reviews the existing record and the judge’s findings.

The fifth level is federal court review. Physicians must file within 60 days of the Council decision. This stage is reserved for high-dollar disputes and typically requires legal representation.

Timelines are one of the most common reasons CMS appeals fail.

Each appeal level has a strict filing window. Missing a deadline usually ends the appeal, regardless of documentation quality.

CMS does not adjust timelines based on patient volume, staffing shortages, or clinical workload. The clock continues to run.

In real practice, deadlines are often missed because responsibility is assumed to belong to someone else. Successful practices assign clear ownership for appeal tracking and submission.

CMS recoupment means Medicare begins withholding money from future payments to recover the alleged overpayment.

Recoupment often starts when an appeal is not filed on time. In some cases, it may continue even while an appeal is under review.

Filing an appeal early improves the chance of delaying or reducing recoupment. Filing late almost always results in payment withholding. Understanding this timing helps physicians protect cash flow.

The CMS audit lookback period refers to how far back Medicare can review claims. In many cases, this period extends several years.

Physicians often assume older claims are safe. They are not.

When CMS identifies a billing pattern, it may extrapolate findings across multiple claims. This can significantly increase financial exposure beyond the original audit sample.

Most CMS appeal losses are tied to documentation issues.

Incomplete progress notes, unclear medical necessity, modifier misuse, copy-paste errors in EHR systems, and missing provider signatures are common problems.

Medical necessity must be clear in the assessment and plan. Modifiers must match what is documented. EHR entries should reflect the actual encounter, not templates. All records must be properly signed before submission.

These issues should be addressed before filing an appeal, not after.

A cardiologist billed modifier 59 for stress tests. CMS denied the claims because the documentation did not clearly support distinct services. The appeal failed at the MAC level due to insufficient separation in the record.

A dermatologist billed multiple lesion removals but did not clearly document lesion size and location. CMS denied the claims for lack of medical necessity. The appeal succeeded at the QIC level after existing documentation was clearly aligned with coverage requirements.

A family practice experienced repeated denials for level 4 E/M visits. Some MACs apply stricter scrutiny to E/M documentation. The appeal succeeded at the ALJ level after testimony clarified medical necessity already reflected in the records.

Successful appeals start early. Documentation should be organized and reviewed before submission. Compliance checklists help identify gaps.

Practices that assign appeal responsibility to a specific role perform better than those relying on shared ownership. Complex cases benefit from billing or compliance expertise. Appeal status should be tracked closely to avoid missed deadlines.

The CMS audit appeal process is not intuitive, but it is manageable when approached strategically.

Understanding appeal levels, timelines, and documentation expectations helps physicians protect revenue and maintain compliance. Most audit losses occur due to confusion, delay, or weak records, not fraud.

Clear knowledge leads to better decisions and lower long-term risk.

Arj Fatima is a senior U.S. medical billing and compliance writer with hands-on experience analyzing CMS audits, Medicare denials, and physician documentation risks. She works closely with Revenue Cycle Management teams and physician practices to translate complex CMS rules into clear, practical guidance. Her focus is audit prevention, appeal strategy, and revenue protection for U.S. healthcare providers.

© Billing MedTech. All Rights Reserved