Are you ready to grow up your business? Contact Us

Call us anytime

Are you ready to grow up your business? Contact Us

Oncology billing is one of the most complex and high-risk areas of U.S. medical billing. Even well-run practices struggle with it. Cancer care involves expensive drugs, time-based services, and long treatment cycles. Every step must be coded and documented correctly, or payments are delayed, reduced, or taken back later.

Many oncologists deliver excellent care but still face denials, audits, and revenue loss. In most cases, the issue is not the care provided. It is unclear whether billing rules, documentation gaps, or small coding errors trigger payer action months after the visit.

This guide explains oncology billing and coding in simple, clear language. It walks through how billing actually works, where practices lose money, and how to reduce risk without adding burden to already busy clinical workflows.

Oncology billing is different from most other specialties. Treatments often span months. Drugs are high-cost. Services are time-based. Payers apply strict medical necessity rules.

Medicare and commercial payers closely monitor oncology claims because even small errors can result in large overpayments. This is why oncology practices face more audits than many other specialties.

In real practice, common problems include prior authorization delays, documentation that does not fully support chemotherapy administration, and confusion around modifiers. One solo oncology practice in Texas lost over twelve thousand dollars in a year due to incorrect use of modifier 59 on infusion claims. The care was correct. The billing support was not.

Oncology billing and coding is the process of converting cancer care into standardized codes so payers can review and pay claims.

Coding describes what was done and why it was medically necessary using CPT, HCPCS, and ICD-10-CM codes. Billing is the submission of those codes on a claim, usually through a CMS-1500 form, followed by payment posting and follow-up.

If documentation does not clearly support the codes billed, payers may deny the claim or approve payment and later take it back during an audit.

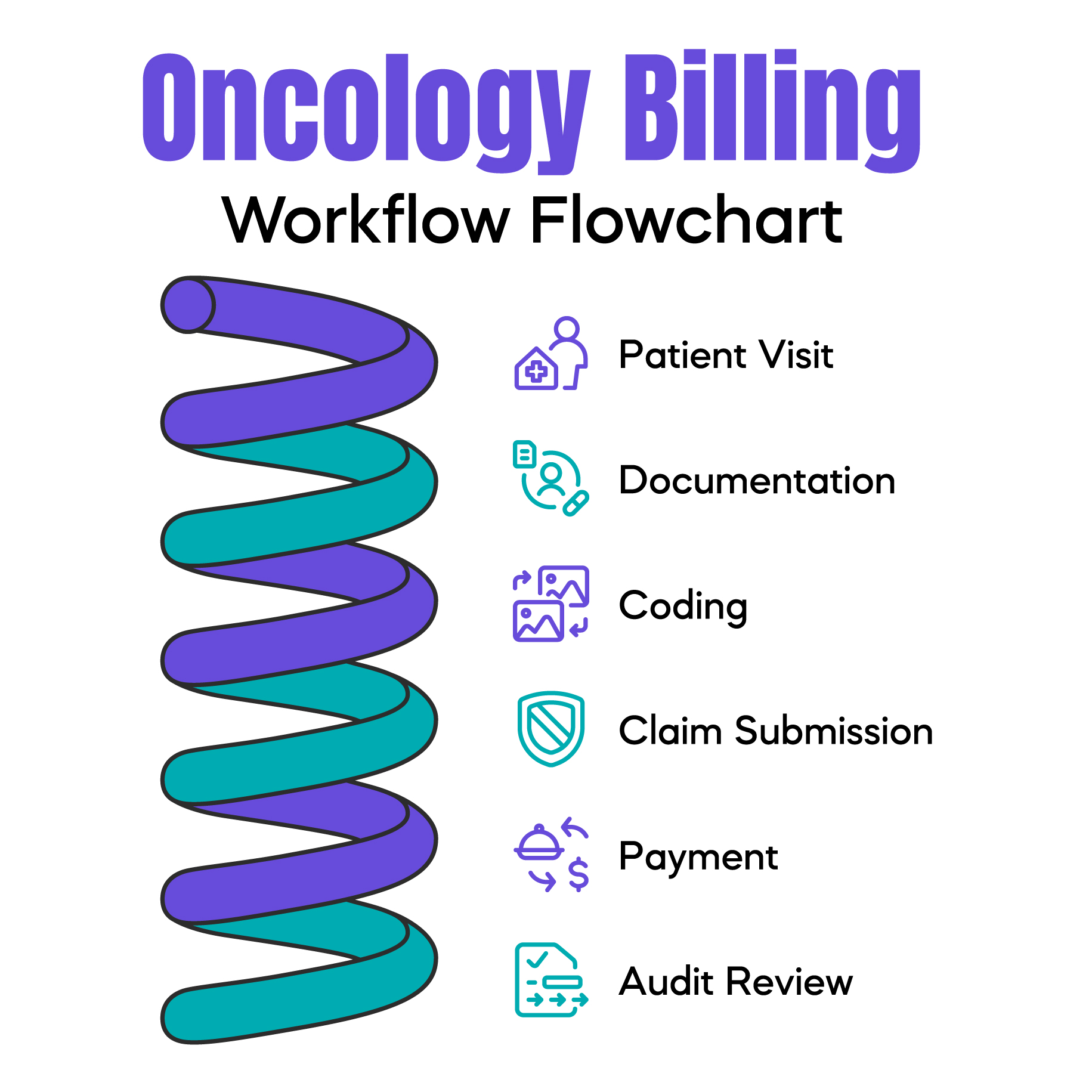

Understanding the full billing workflow helps explain where errors start.

A patient visit occurs. Clinical notes are entered into the EHR. Drug administration details are recorded by nursing staff. Charges are captured. Codes are assigned. A claim is created and sent through a clearinghouse. The payer reviews it. Payment or denial is issued. Some claims are reviewed again months later during post-payment audits.

Most competitors explain codes but skip this process. In real life, most billing problems begin early. Missing infusion times, unclear drug units, or weak medical necessity documentation may not cause immediate denials but often lead to future audits.

Oncology CPT codes often confuse because many are time-based and sequence-dependent.

Evaluation and Management codes describe office visits. When billed on the same day as chemotherapy, documentation must clearly support a separate, significant service. Payers frequently review these claims.

Chemotherapy administration codes describe how drugs are given. Infusions, injections, and pushes are coded differently. The order of administration matters. Time documentation matters.

In many oncology audits, practices lose revenue simply because infusion start and stop times were not clearly documented.

Diagnosis codes explain why cancer treatment was medically necessary. In oncology, specificity is critical.

Cancer site, type, laterality, and treatment status must align with the service billed. Active cancer codes differ from history-of-cancer codes. Payers often deny claims when diagnosis codes do not support the drug or service.

Auditors look for a clear connection between diagnosis and treatment. Vague or outdated codes increase the risk of denial.

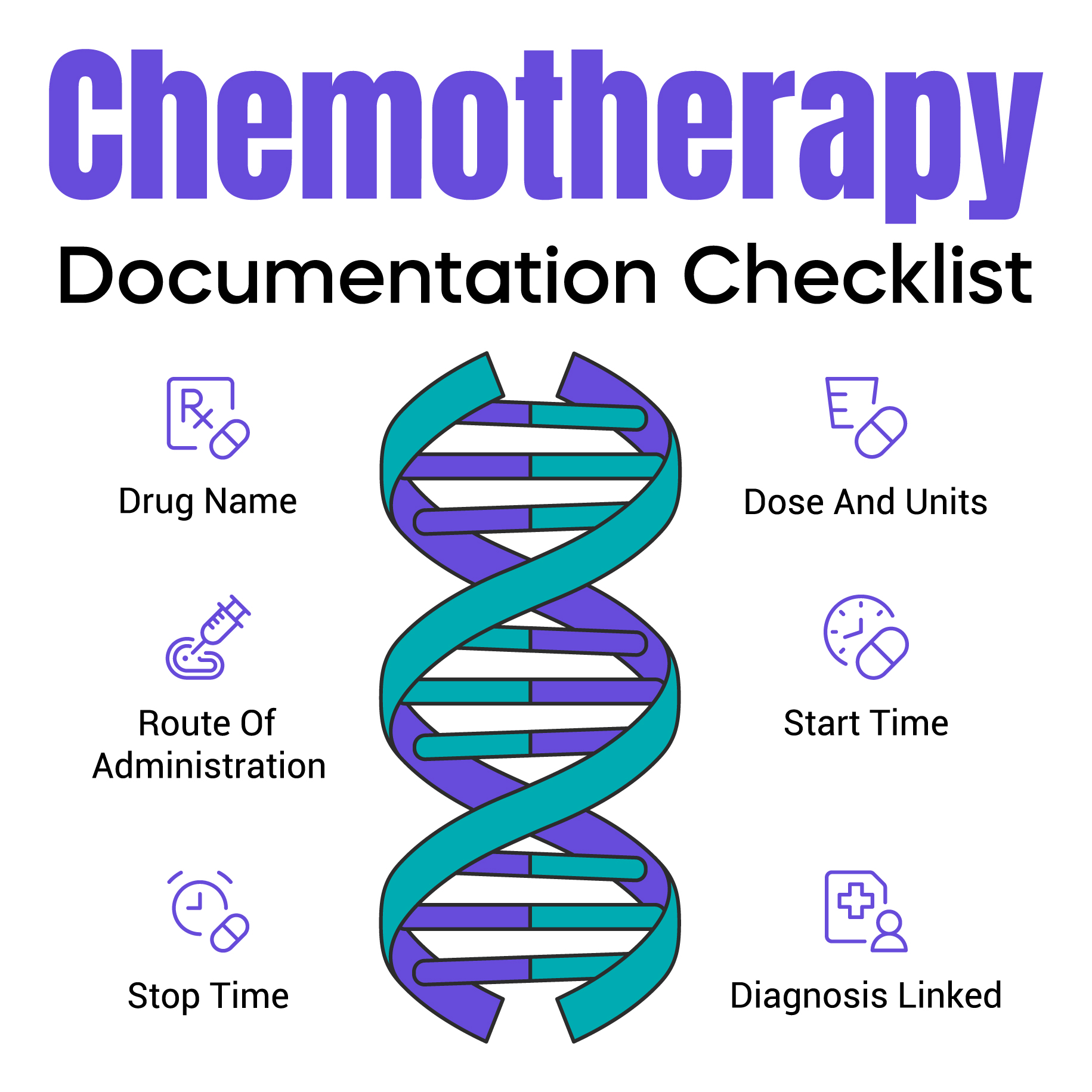

Chemotherapy billing is one of the highest-risk areas in oncology.

Infusion services are time-based. Documentation must include clear start and stop times. Nursing notes must show what drug was given, how it was administered, and for how long.

Sequencing rules apply when multiple drugs are administered. The primary service must be billed correctly. Incorrect sequencing often results in underpayment or recoupment.

A common real-world issue is the assumed infusion time. Payers do not accept assumptions. They require documented proof.

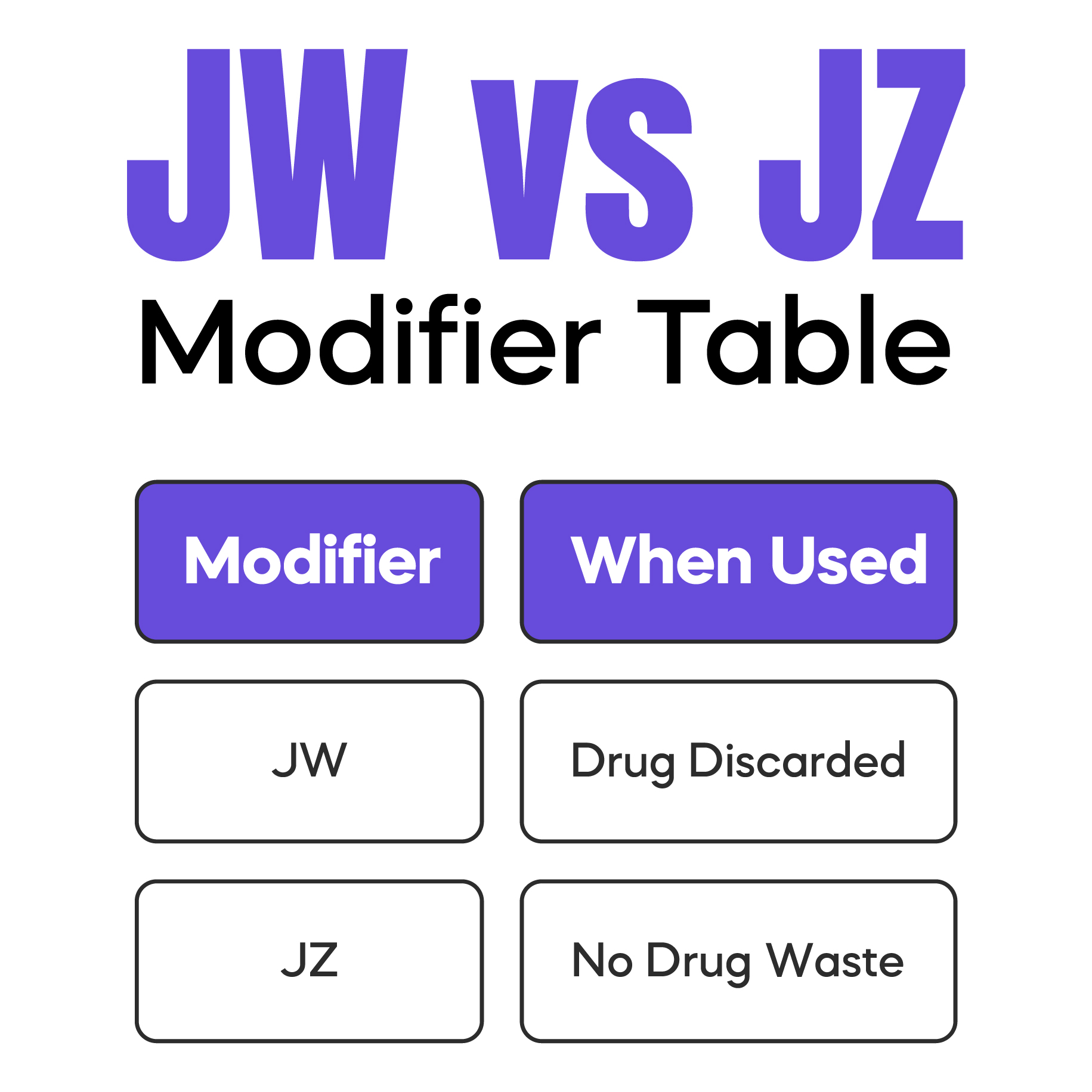

Drug wastage is a major audit trigger in oncology billing.

When part of a single-use vial is discarded, Medicare allows billing for wasted units using the JW modifier, but only when documentation clearly supports the amount administered and the amount wasted.

Many practices apply JW automatically. This increases audit risk. Auditors frequently request records months later. If wastage is not clearly documented, payments may be recouped.

The JZ modifier is used when no drug waste occurs. Using the wrong modifier or missing documentation raises red flags.

Radiation therapy billing includes multiple stages such as simulation, planning, and treatment delivery. Each stage has its own CPT codes.

Claims are often denied when simulation services are not billed correctly or when unlisted codes are used excessively. Local Coverage Determinations may restrict certain radiation codes based on diagnosis or treatment intent.

CMS audits frequently focus on practices with unusually high use of unlisted radiation codes.

Medicare rules play a major role in oncology billing decisions. National Coverage Determinations apply nationwide. Local Coverage Determinations vary by Medicare Administrative Contractor.

Many practices follow CMS rules but miss local MAC requirements. This is a common cause of unexpected denials, especially for newer drugs or off-label use.

Understanding local payer behavior is essential for stable reimbursement.

Auditors compare physician notes, nursing documentation, drug records, and claims for consistency.

They look for medical necessity, accurate drug units, clear infusion times, and proper modifier support. Missing signatures, copied notes, or vague documentation often lead to recoupments.

These issues are preventable with simple, consistent documentation habits.

Most oncology denials stem from the same issues. Missing prior authorization for chemotherapy drugs. Incorrect modifier use. Diagnosis codes that do not match services. Incomplete infusion documentation.

One oncology practice in Florida reduced denials by forty percent after correcting diagnosis-to-procedure mismatches. The care did not change. The billing accuracy did.

Practices that reduce billing risk focus on clarity and consistency.

Clear documentation, regular denial reviews, staff education on modifier use, and awareness of payer rules all help. Billing should support care, not complicate it.

Some practices seek outside billing support when internal workflows become too complex or when audits increase. The goal is not to lose control, but to protect revenue while remaining compliant.

Oncology billing and coding require accurate documentation, correct coding, and strong awareness of payer rules. Because oncology services are high-cost and time-based, small billing errors can lead to denials or audits. Clear workflows and consistent documentation protect both revenue and compliance.

For your convenience, we’ve created a printable, one-page oncology billing cheat sheet that brings together commonly used CPT codes, HCPCS J-codes, ICD-10-CM diagnosis codes, high-risk modifiers, and key documentation reminders. This quick reference is designed to support accurate chemotherapy and immunotherapy billing, reduce denials, and simplify daily coding decisions. You can download the cheat sheet below and keep it on hand as a practical guide for your oncology billing workflow.

Download the Oncology Billing Cheat Sheet (PDF)![]()

Arj Fatima is a U.S. medical billing and compliance writer with real-world experience supporting oncology and specialty practices. Her work focuses on denial prevention, audit readiness, documentation accuracy, and payer compliance. She writes clear, physician-focused education that helps practices protect revenue while meeting CMS and payer requirements.

© Billing MedTech. All Rights Reserved