Are you ready to grow up your business? Contact Us

Call us anytime

Are you ready to grow up your business? Contact Us

Accounts Receivable (AR) Days is one of the most important financial indicators for any medical practice. It shows how long it takes to turn charges into collected revenue. For U.S. physicians, administrators, and billing teams, understanding this number is essential for maintaining healthy cash flow and identifying revenue cycle issues before they grow.

This guide explains how to calculate AR Days step-by-step, which numbers to use, benchmarks for different practice types, and what to fix if your AR Days is higher than it should be.

AR Days represents the average number of days your practice takes to collect payments after generating a charge. In simple terms, it measures how long your money stays in “uncollected status” before it hits your bank account.

For physicians, AR Days reveals more than just billing speed. It shows how efficiently your practice handles claims, follow-ups, denials, and patient collections. A low AR Days number means consistent cash flow and a strong revenue cycle. A high AR Days number signals slow collections, payer issues, or workflow gaps.

When monitored monthly, AR Days becomes a leading indicator of financial health, helping practices identify trends before they impact payroll or growth plans.

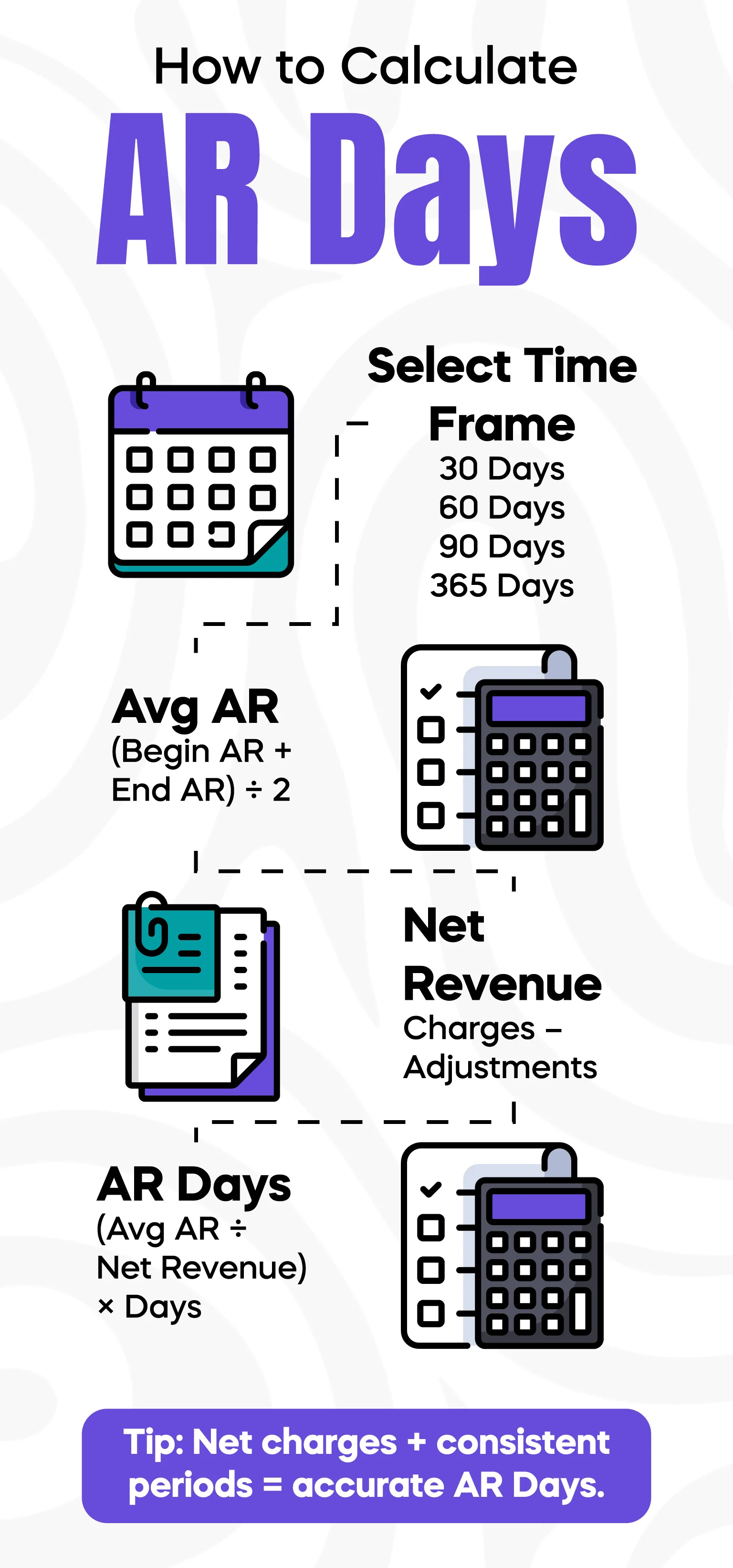

The AR Days formula is straightforward, but many practices calculate it incorrectly by using the wrong revenue number or mixing different time windows. When done correctly, AR Days is one of the most reliable RCM metrics.

The formula is:

AR Days = Total AR ÷ Average Daily Net Charges

Below is the step-by-step breakdown.

Most U.S. practices calculate AR Days using 90 days of data because it smooths fluctuations. A 30-day window is useful for fast-moving specialties like urgent care, while multi-specialty groups often prefer 60 days.

The key is consistency: use the same window every month so your comparisons remain meaningful.

Add up your AR balances for the selected period and divide by the number of days. This gives a more accurate representation than taking a single day’s snapshot.

For example, if your daily AR balances over 90 days average out to $450,000, that becomes your Average AR Balance.

This is the most commonly misunderstood step.

Net Patient Revenue = Gross Charges – Adjustments

(Contractual adjustments, write-offs, and discounts)

Gross charges inflate your revenue artificially and make AR Days look lower than they actually are. Net charges reflect the real collectible amount and should always be used for AR calculations.

To get your Average Daily Net Charges:

Divide the total net charges from the time window by the number of days.

Now plug the values into the formula:

AR Days = Average AR Balance ÷ Average Daily Net Charges

If your practice has:

Average AR Balance = $450,000

Average Daily Net Charges = $15,000

Then:

AR Days = 450,000 ÷ 15,000 = 30 Days

This means your practice takes an average of 30 days to collect earned revenue—a strong performance by U.S. standards.

Using gross charges is one of the biggest reasons physicians mistakenly believe their billing is performing better than it actually is. Gross charges include amounts you will never be paid due to payer contracts. When used in the AR Days formula, they artificially reduce your result.

Net charges reflect the true collectible revenue after contractual adjustments. Using net charges gives a realistic and defensible measurement, especially when discussing performance with auditors, CFOs, or external billing vendors.

If your billing team is calculating AR Days using gross revenue, it’s time to update the process.

There is no single benchmark for every medical specialty, but U.S. industry averages provide helpful guidelines:

Specialty benchmarks:

If your AR Days is above the benchmark for your specialty, deeper analysis is needed.

Even experienced billing teams sometimes miscalculate AR Days. The most common mistakes include:

Combining Insurance and Patient AR

Insurance AR moves faster than patient AR, so mixing them hides problems. Always track them separately.

Ignoring Adjustments

If adjustments are delayed or inaccurate, your net charges become skewed, and AR Days become unreliable.

Seasonal Fluctuations

Many specialties see seasonal charge spikes. If you use only a 30-day window during a busy month, AR Days may appear inflated.

Mismatched Time Windows

If AR balance uses 90 days but revenue uses 30 days, the result becomes meaningless. Keep windows identical.

Avoiding these errors ensures clean, comparable AR Days results monthly.

If your AR Days are higher than the benchmark, your practice is waiting too long to collect healthcare revenue. This slows cash flow and increases write-off risk.

Here’s what to analyze first.

Focus your staff on the highest-risk categories:

0–30 days

31–60 days

61–90 days

91–120 days

120+ days

Any AR older than 90 days requires immediate escalation. Claims in the 120+ bucket often convert into write-offs if not submitted or followed up on quickly.

Insurance payers follow predictable patterns. Patient responsibility does not.

Patients delay payments due to:

High deductibles

Confusing statements

Lack of follow-up

Financial hardship

Separating AR helps identify whether the problem is payer-related or patient-related.

Denials are a major driver of increased AR Days.

Common issues include:

Eligibility errors

Coding mistakes

Missing documents

Prior authorization failures

Practices with strong denial workflows often see AR Days drop by 10–15 days within months.

Modern billing softwares help monitor AR trends daily. Look for tools that automate:

Denial alerts

Payment tracking

Follow-up queues

AR aging reports

Payer performance summaries

Technology gives your team the visibility needed to reduce AR Days consistently.

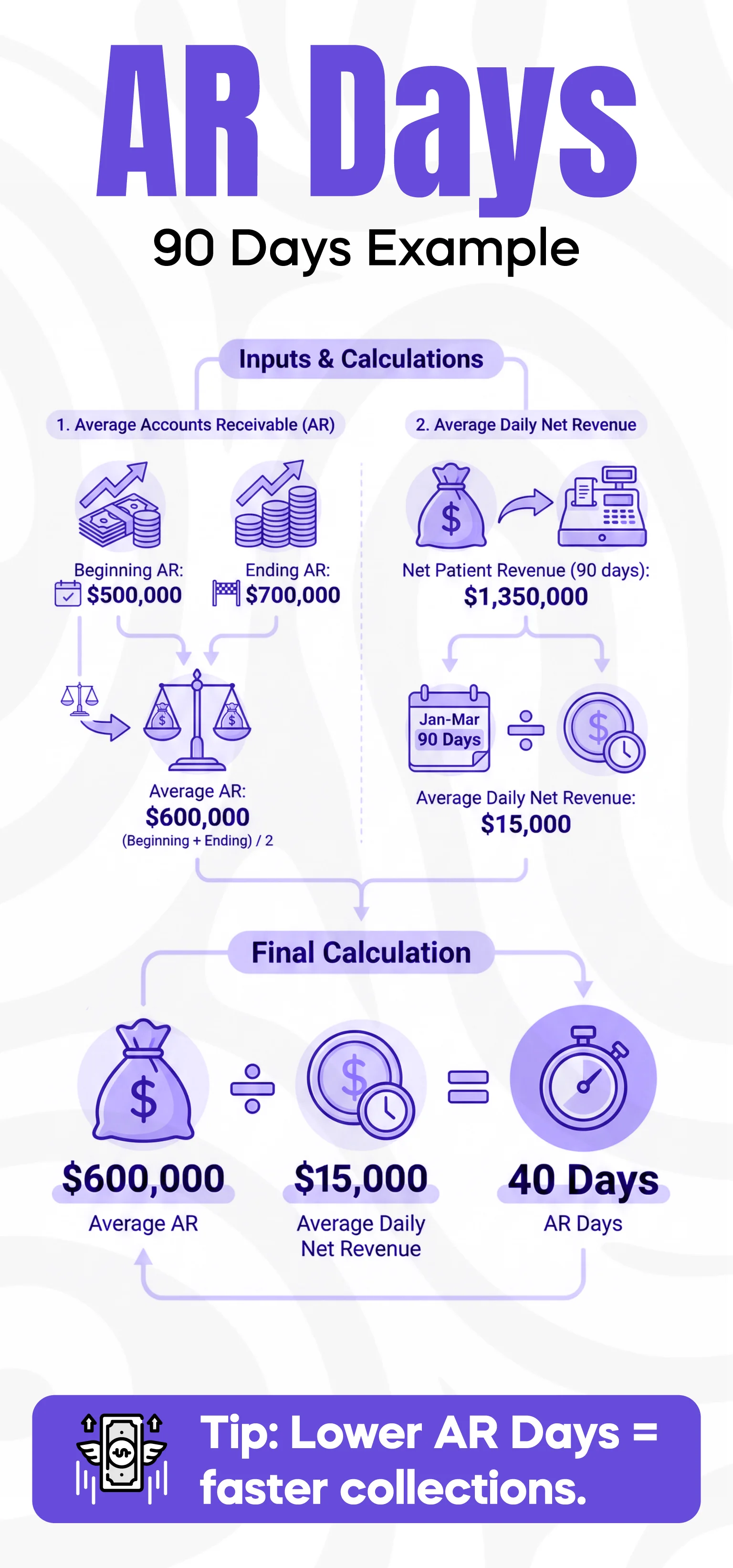

Your practice wants to calculate AR Days for the past 90 days.

Step 1 – Time Window: 90 days

Step 2 – Average AR Balance: $600,000

Step 3 – Net Charges (90 days): $1,350,000

Average Daily Net Charges = $1,350,000 ÷ 90 = $15,000

AR Days = $600,000 ÷ $15,000 = 40 Days

A result of 40 days is acceptable for many specialties, but may signal slow payer response or denial issues if your specialty normally averages 30–35 days.

Recalculate AR Days monthly to track trends accurately. Larger medical groups may review AR Days weekly or bi-weekly. Quarterly reviews help identify broader patterns, especially related to seasonal fluctuations or payer policy changes.

The key is consistent methodology—same window, same charge type (net), and same calculation method.

AR Days is only one part of your financial health. It should be reviewed alongside:

Denial Rate

Net Collection Rate

Percentage of AR Over 90 Days

Charge Lag Days

Patient Collections Rate

These metrics together create a complete picture of your revenue cycle performance.

1. What does AR Days mean in medical billing?

It represents the average number of days it takes for your practice to collect revenue after charges are generated.

2. What formula is used for AR Days?

AR Days = Total AR ÷ Average Daily Net Charges.

3. Do you use gross or net revenue for AR Days?

Use net revenue only. Gross revenue inflates results and makes AR Days appear artificially low.

4. What is a good AR Days benchmark?

Under 30–35 days is strong. Over 45–50 days indicates issues that require attention.

5. How often should AR Days be calculated?

Monthly, using the same time window for consistency.

6. What drives high AR Days?

Denials, slow follow-up, patient responsibility, and inaccurate charge posting.

7. Should insurance and patient AR be separated?

Yes. Mixing them hides the real source of delays.

8. Do AR Days affect cash flow?

Absolutely. High AR Days means delayed revenue and financial strain.

9. Can software help reduce AR Days?

Yes. Automation improves visibility and speeds up follow-up.

10. Are AR Days enough to measure billing performance?

No. It must be reviewed with other KPIs like denial rate and net collection rate.

Written by a U.S. Healthcare RCM Strategist with 12+ years of experience helping physician groups, clinics, and hospitals optimize their medical billing operations. Specializes in AR management, denial reduction, and building efficient revenue cycle teams.

© Billing MedTech. All Rights Reserved