Are you ready to grow up your business? Contact Us

Call us anytime

Are you ready to grow up your business? Contact Us

As an ophthalmologist, your focus should stay on protecting vision, not fighting insurance companies over payments. Yet in today’s U.S. healthcare system, even a small coding error or incomplete note can trigger a denial and delay your reimbursement. When you perform cataract surgery or manage advanced glaucoma, you deserve accurate and timely payment for your expertise. But payers now rely on automated edits, claim scrubbing tools, and data analytics to flag minor inconsistencies. This is where a structured and compliant ophthalmology billing process becomes essential.

A strong ophthalmology billing service does more than submit claims. It verifies medical necessity, applies the correct CPT and ICD-10-CM codes, checks modifier accuracy, and ensures documentation supports every service billed. This guide explains why ophthalmology claim denials occur and how to prevent them before submission. By tightening your billing workflow and strengthening compliance safeguards, you can reduce appeals, protect revenue, and maintain steady cash flow without unnecessary administrative stress.

Every denied claim costs your practice more than just the initial payment. You must also account for the labor hours your staff spends investigating the error, contacting the payer, and resubmitting the paperwork. According to common industry estimates, the cost to rework a single claim can exceed twenty-five dollars. For a high-volume ophthalmology practice, these costs add up quickly.

If your denial rate is above five percent, you are providing free care for several days every month. Beyond the financial impact, denials frustrate your team and can lead to patient dissatisfaction if they receive unexpected bills. Understanding the root causes of these rejections is the first step toward protecting the financial health of your clinic.

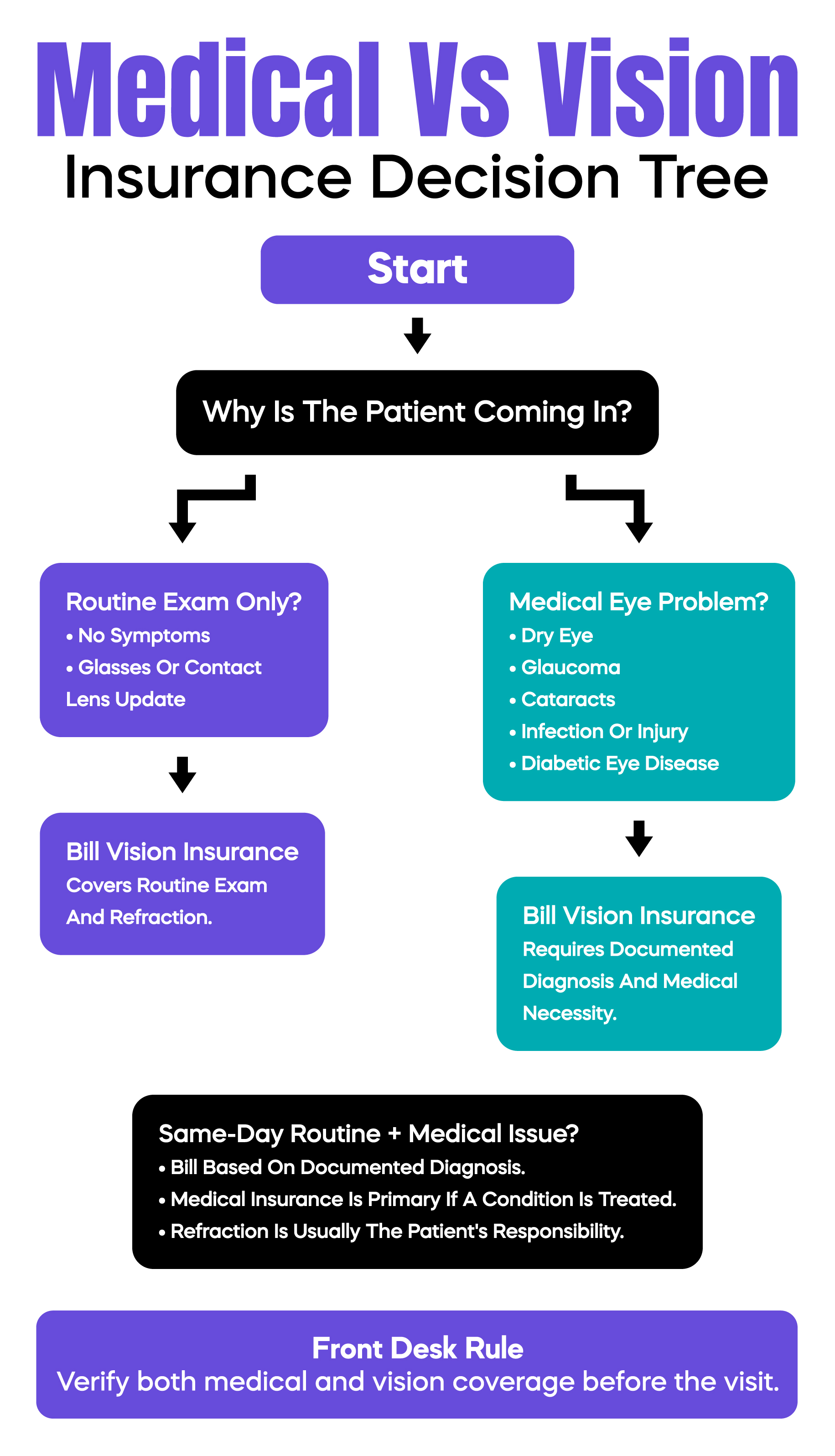

One of the most common reasons eye care claims are denied is confusion between medical and vision insurance. Many patients believe every visit to an eye doctor should go through their vision plan. That is not correct. Vision plans are designed for routine eye exams and corrective lenses. If the visit is for a medical problem such as dry eye syndrome, macular degeneration, glaucoma, or an eye infection, the claim must be billed to medical insurance.

The payer selection must be based on medical necessity and documented diagnosis, not patient preference. When a claim is submitted to the wrong plan, it is usually denied immediately. To prevent this, the front desk should verify both before the appointment. During scheduling, staff should clearly ask the reason for the visit and confirm coverage accordingly.

If a patient presents for a routine exam but also reports symptoms that require medical evaluation, the claim must follow the documented findings. When a medical condition is addressed, medical insurance becomes primary. Refraction is typically not covered by medical plans and remains the patient's responsibility. Proper intake screening and clear documentation reduce denials and audit risk.

Ophthalmology is unique because it employs two distinct code sets: Eye Codes (920xx) and E/M Codes (the 99202–99215 family). Many practices mix these incorrectly, leading to frequent rejections. Eye codes like 92004 and 92014 focus on eye-specific evaluations and often have stable reimbursement rates for routine medical checks. In contrast, E/M codes require a level of medical decision-making (MDM) or a specific amount of time spent that must be meticulously documented.

Many commercial payers and certain Medicare Administrative Contractors (MACs) impose frequency limits on how often 92004 or 92014 can be billed, often restricted to once every twelve months, depending on the specific plan. If a patient returns for a follow-up on a medical condition and you bill 92014 again instead of an appropriate E/M code, the claim may be denied due to these plan-dependent frequency edits. Prevention requires your team to understand the "medical element" of the visit and verify payer-specific frequency policies before submission.

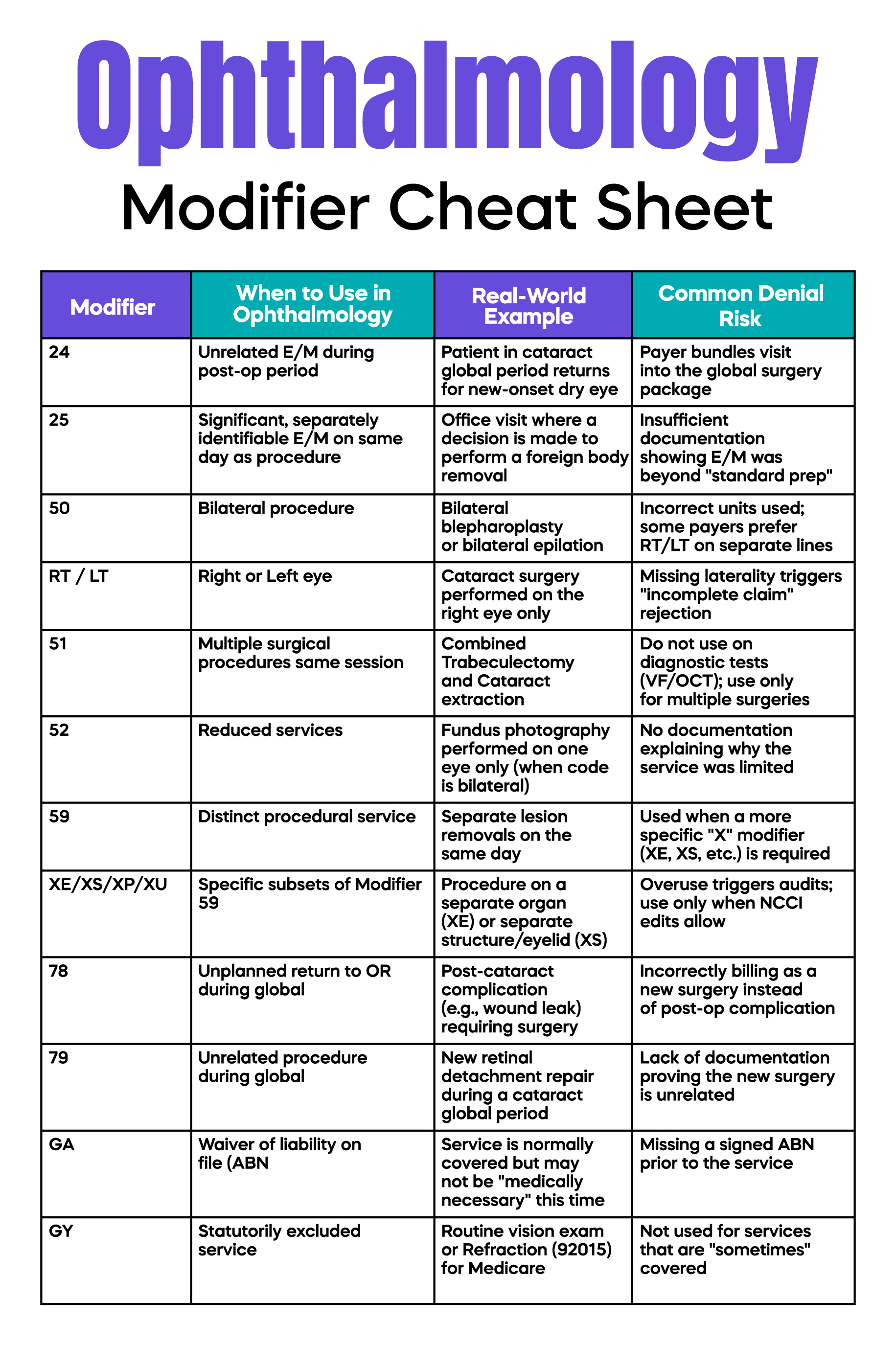

Modifiers are the small but mighty two-character codes that can completely change how a claim is processed. Modifier 25 is used when you provide a significant, separate evaluation and management service on the same day as a procedure. If your documentation does not clearly show that the office visit was distinct from the procedure, the payer will "bundle" the services and deny the E/M claim.

Laterality (RT for right eye, LT for left eye) is another major target for audits. In modern billing, diagnosis codes must be specific; using a "non-specific" code like H25.9 for an unspecified cataract is a red flag. You must use specific codes, such as H25.811, for a right-eye cataract. If the diagnosis code points to the right eye but your procedure code or modifier points to the left, the claim will be denied instantly. Your electronic health record system should be set up to prompt for laterality every time a diagnosis or procedure is entered.

Many ophthalmic surgeries, such as cataract surgery, have a 90-day global period. This means routine post-operative visits, suture removals, and standard follow-up care are included in the initial surgical fee. Billing these services separately during that 90-day window results in automatic denials.

If a patient requires an unrelated service or treats a complication that qualifies as a separate event, you must use modifiers like -24 (unrelated E/M during post-op) or -79 (unrelated procedure during post-op). Without these, the insurance system assumes the visit is part of the original surgery and refuses to pay. Training your providers to understand what is included in the global package is essential for clean surgical billing.

Retina practices face specific challenges when billing for intravitreal injections (CPT 67028) and the associated medications (J-codes). Denials in this area are often high-dollar and occur when the diagnosis code does not match the drug’s approved indication or when wastage documentation is missing.

For single-use vials, Medicare now mandates the use of specific modifiers: the JW modifier to report the amount of drug wasted, and the JZ modifier to affirmatively report when there is zero waste. This JZ reporting is now a requirement for compliance. If the units billed do not match your clinical notes, or if the "linkage" between the symptom and the diagnosis is weak, the drug claim will fail.

Many modern eye care treatments, especially expensive injections and advanced imaging like OCT, now require "prior authorization" or permission from the insurance company before the service is provided. Failing to obtain this authorization is an automatic denial that is almost impossible to appeal.

When a payer requires an authorization number, it is typically reported in Box 23 of the CMS-1500 form. However, requirements vary significantly by payer. Relying on verbal confirmations is no longer a safe practice; your staff should leverage digital portals to secure and document these numbers to bypass automated payer gatekeepers.

Each MAC publishes Local Coverage Determinations (LCDs) that define when a test is "medically necessary." For example, an OCT must meet specific clinical criteria to be covered. Simply uploading an image into the EHR is not enough; you must document the interpretation and report.

Avoid "cloned" notes where every patient’s chart looks identical, as this triggers "template fatigue" audits from automated payer systems. Your notes must tell the unique story of the patient’s clinical findings for that specific date of service to satisfy medical necessity requirements.

To stop denials, you must start at the beginning of the patient’s journey. The registration process is where many errors begin. If a staff member mistypes a member ID or forgets to update an expired policy, the claim will fail. You should implement a policy of "zero-fault registration" where insurance cards are scanned and verified at every visit.

Beyond the front desk, clinical documentation must be precise. Periodically review a random sample of charts to ensure the documentation supports the codes billed. Performing monthly denial trend reporting by category allows you to provide targeted training to your staff and correct systemic errors before they trigger an official audit.

Arj Fatima is a Senior Medical Billing Strategist specializing in high-volume U.S. ophthalmology and optometry practices. With over 15 years of experience navigating the complexities of CMS-1500 submissions and MAC-specific LCDs, Arj has helped multi-specialty eye clinics reduce denial rates from 18% to under 4%. Her expertise lies in bridging the gap between clinical documentation and clean-claim submission.

© Billing MedTech. All Rights Reserved