Are you ready to grow up your business? Contact Us

Call us anytime

Are you ready to grow up your business? Contact Us

Many doctors believe revenue falls only when patient volume drops.

In reality, most medical practices lose money even when schedules remain full.

Claims are submitted on time. Patients are seen daily. Notes are completed in the EHR.

Yet collections do not match expectations.

This happens because medical practice revenue often leaks quietly.

Payments arrive, but they are lower than they should be. Coding looks correct, but documentation does not fully support it. Denials occur, but they are never fully appealed.

Over time, these small issues add up. Revenue drops without a clear warning.

This article explains where medical practice revenue leaks in real U.S. practices and how doctors can fix it before losses grow into audits, refunds, or compliance problems.

Medical practice revenue rarely drops suddenly.

It declines slowly, month after month.

Most physicians notice that patient volume stays stable. Staffing remains the same. Visit types do not change much. Still, deposits shrink.

This happens because payment accuracy matters more than volume.

Even small underpayments on each claim create major losses when repeated hundreds of times.

Many payers, including Medicare and large commercial plans, now rely on automated claim processing. If documentation or coding does not clearly justify payment, the system reduces reimbursement automatically.

Doctors often assume that a paid claim means a correctly paid claim.

In U.S. medical billing, that assumption is one of the biggest causes of revenue loss.

Revenue leakage in medical billing happens in predictable places.

These leaks appear across specialties, regardless of practice size.

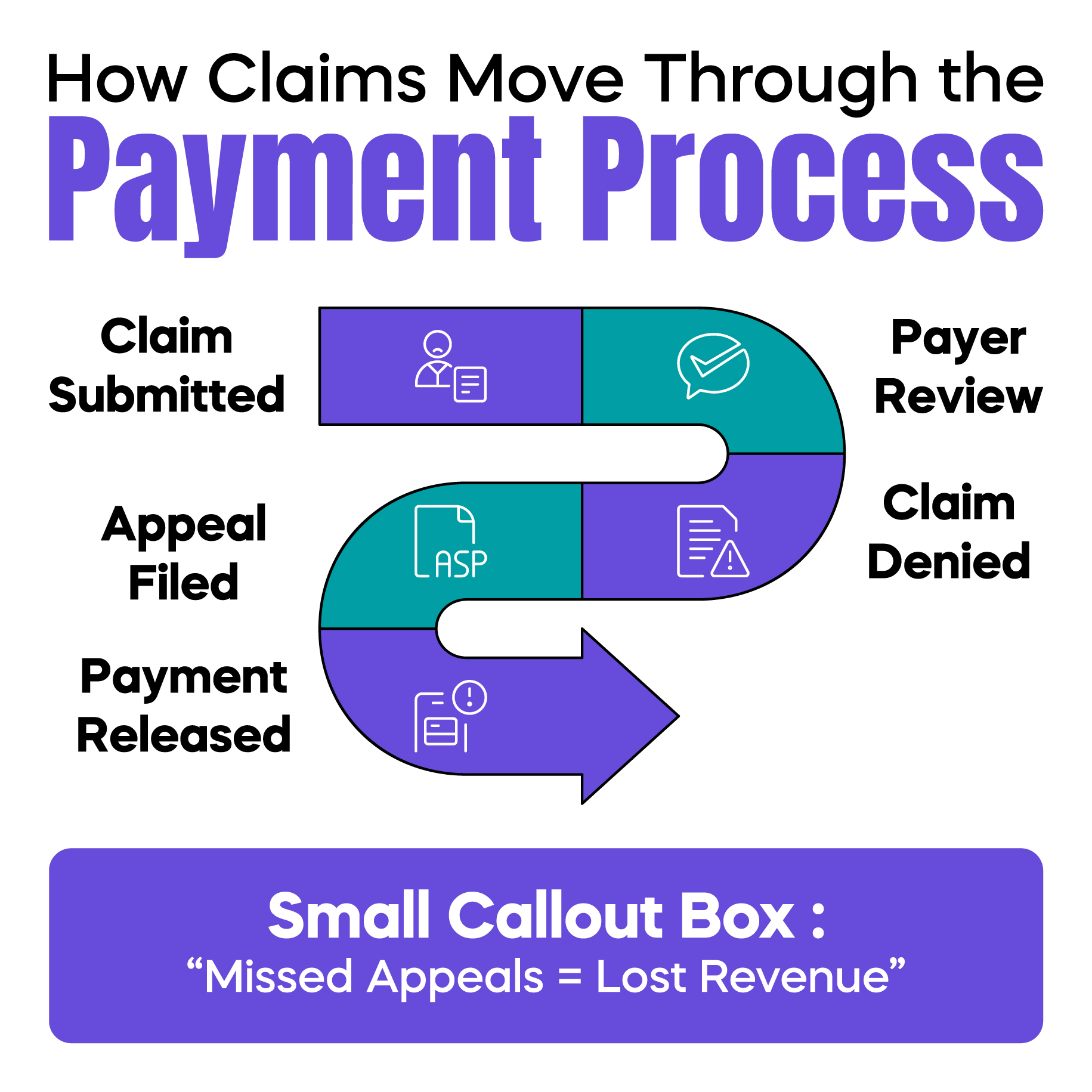

Not every denial is wrong, but many are.

In real practice, denied claims often remain untouched.

Staff may lack time. Appeal rules may feel confusing. Some denials appear too small to chase. With the rise of AI in medical billing denials, claims are now rejected faster and more frequently, even when documentation exists.

When denied claims are not appealed correctly and on time, revenue disappears permanently.

One missed appeal may seem minor. Repeated denials for the same issue can erase thousands of dollars each quarter.

Underpayments are harder to detect than denials.

A claim shows as paid, so no alarm is triggered.

However, payment may be reduced due to incorrect modifier pricing, ignored contract rates, or bundling edits. Most practices do not compare allowed amounts against contracted rates. As a result, underpayments remain invisible.

This is one of the most common causes of medical practice revenue loss in U.S. practices today.

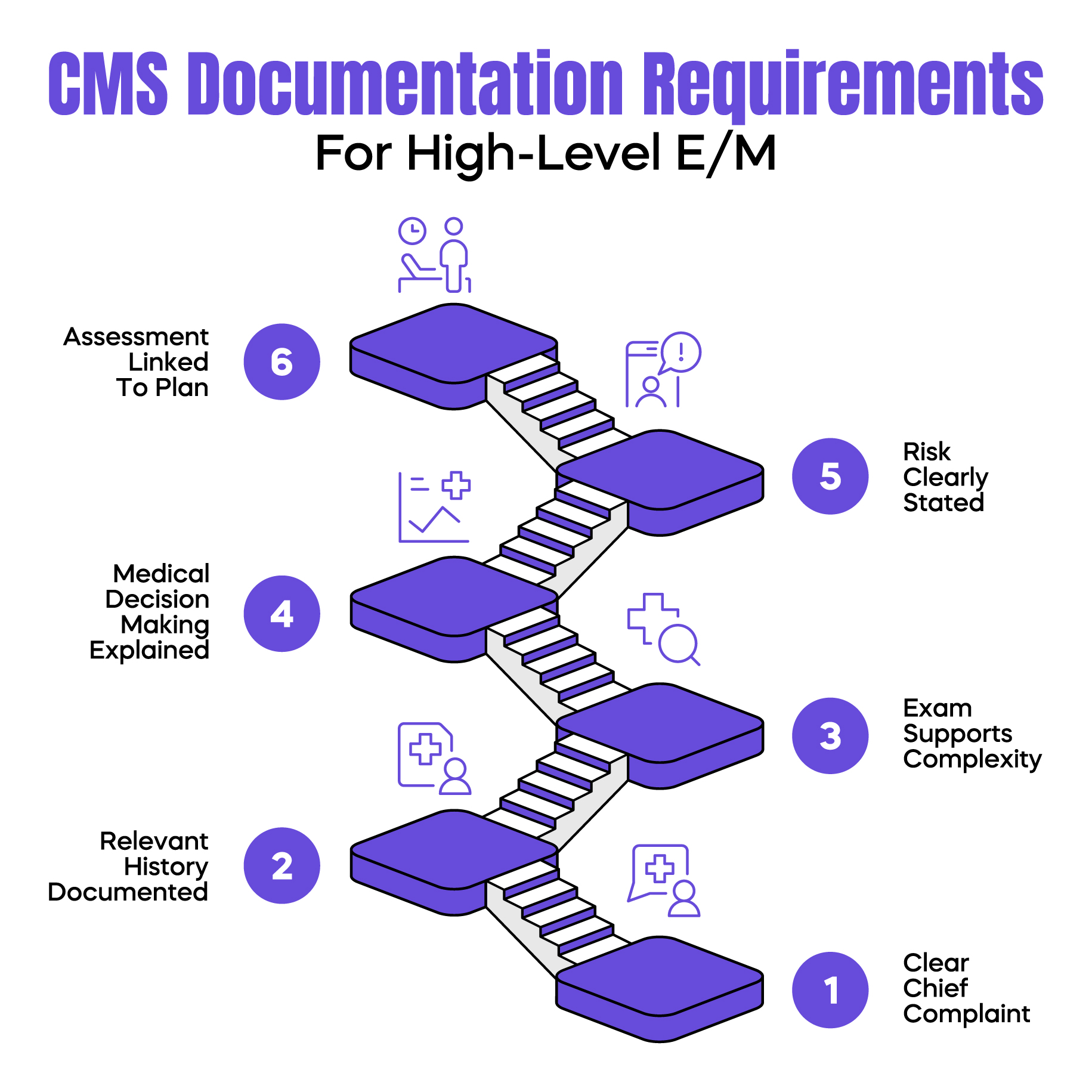

CMS documentation requirements control how claims are paid.

If documentation does not clearly support the service billed, payers reduce payment or downcode automatically.

High-level E/M codes require more than detailed notes.

They require clear medical necessity.

Many physicians document what they did, but not why the service required higher complexity. Decision-making, risk, and condition management are often implied rather than stated.

When medical necessity is not clearly documented, payers lower the E/M level even when care was appropriate. This reduces revenue and increases audit risk.

G2211 remains widely misunderstood.

Some practices avoid it due to fear of audits. Others use it inconsistently without proper documentation.

When used correctly, G2211 supports additional Medicare payment for longitudinal care. When ignored, practices leave legitimate revenue unclaimed. When used incorrectly, it increases compliance risk.

This is a clear example of how confusion leads directly to revenue leakage.

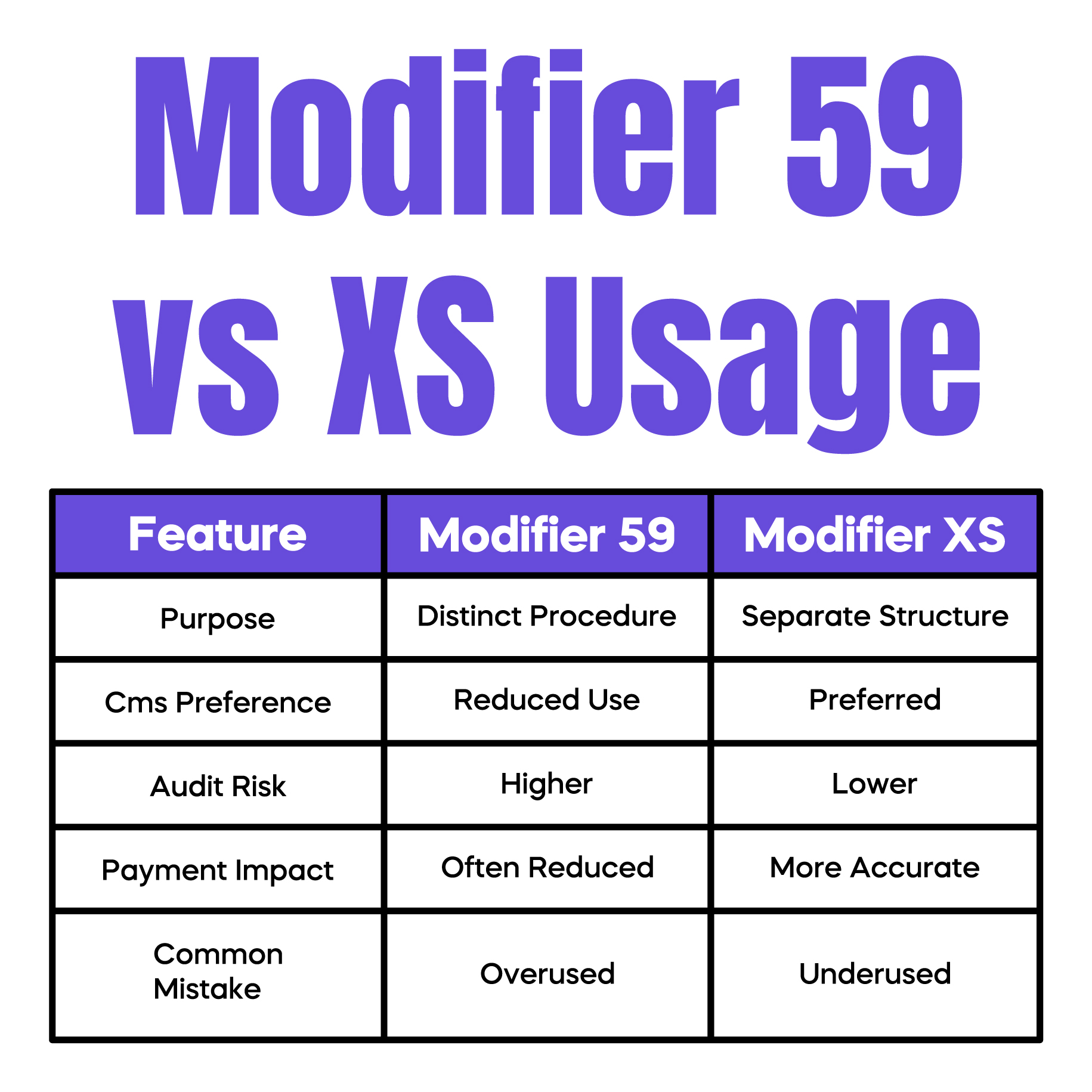

Coding problems rarely cause immediate denials.

They usually cause underpayment.

Modifier misuse is one of the most common silent revenue drains.

Modifier 59 is often overused, while modifier XS is frequently ignored.

Payers increasingly expect correct subset modifiers. When the wrong modifier is used, claims may be reduced, flagged, or audited. Correct modifier selection protects both reimbursement and compliance.

EHR systems record what is entered. They do not prevent omissions.

Services may be provided, but not captured. Add-on procedures, supplies, or minor services are often missed during busy clinic days. When a service is not captured, it cannot be billed.

This loss never appears in denial reports because the claim was never submitted.

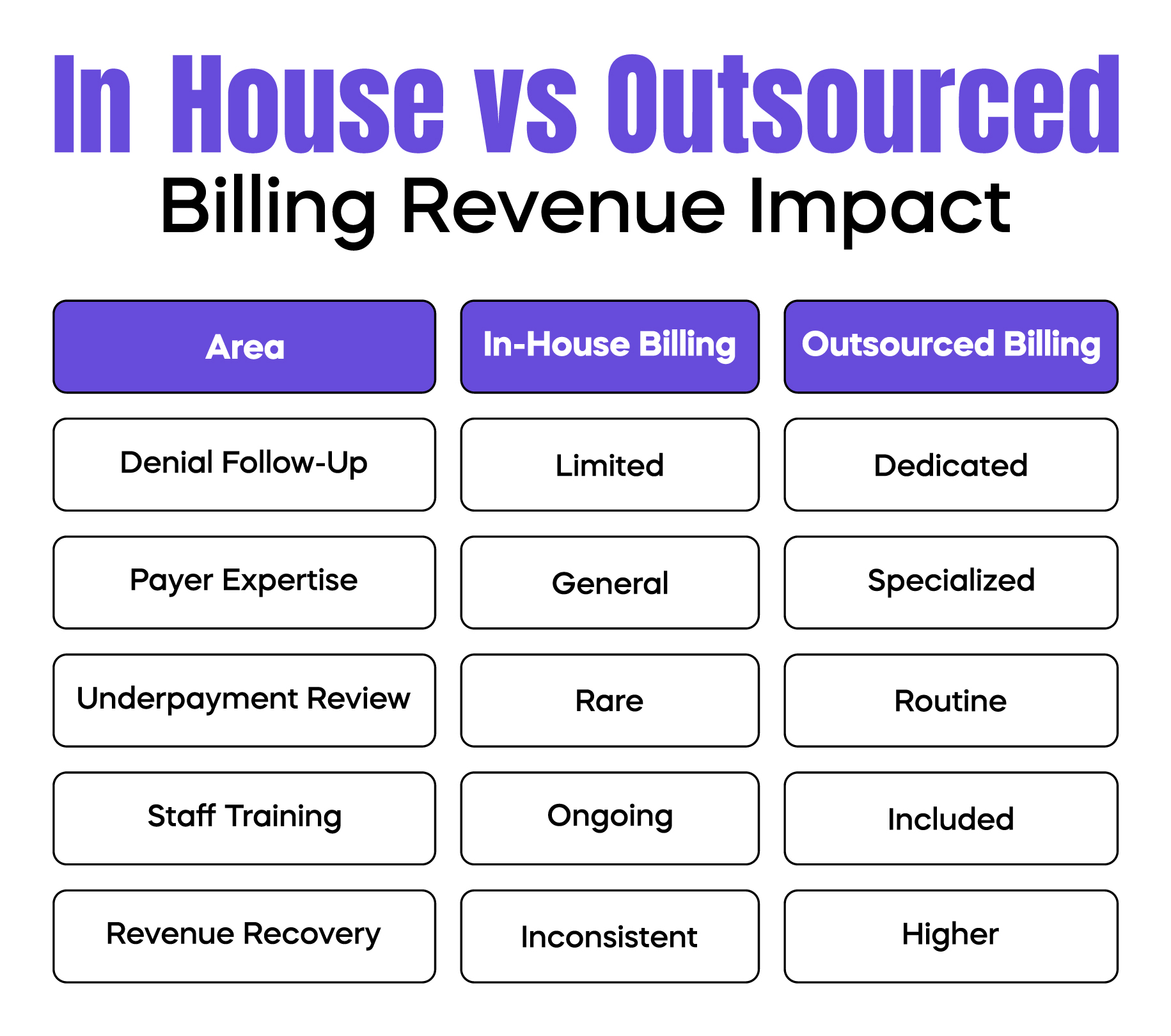

Some revenue leaks are caused by operational choices rather than billing rules.

In-house billing offers control but often lacks payer-specific expertise.

Outsourced billing teams usually monitor payer rule changes, track underpayments, and appeal denials more aggressively.

For many practices, the issue is not billing cost.

It is a missed revenue recovery.

Small practices face unique challenges.

Limited staff, fewer audits, and less payer leverage increase revenue risk as volume grows.

Without structured billing oversight, small documentation or coding errors repeat unchecked and slowly drain revenue.

Fixing medical practice revenue leakage requires order.

Random changes do not work.

Start with documentation accuracy. Ensure medical necessity is clearly stated. Then review denials and underpayments. Audit modifier use. Track payer behavior by plan. Finally, review revenue reports monthly.

This structured approach stops losses before they compound.

Revenue problems often appear before audits.

CMS and MACs monitor billing patterns, downcoding trends, and refund requests.

Unchecked revenue leakage can lead to record requests, overpayment demands, and compliance reviews. Fixing revenue early protects both income and long-term practice stability.

Arj Fatima is a U.S. medical billing and revenue cycle specialist with hands-on experience supporting physician practices across multiple specialties. She has worked directly with Medicare and commercial payers, corrected modifier misuse, resolved denials, and helped practices recover revenue lost due to documentation and coding gaps. Her work focuses on practical, compliance-safe revenue improvement for U.S. medical practices.

© Billing MedTech. All Rights Reserved